2025: A Year in Review

Thank you to my readers

Dear Ultimate Value readers,

I wanted to take a moment to express my gratitude for your support.

I am flattered that people choose to read (and pay!) for my work. And for that, I am beyond grateful.

Thank you again for your support and for being part of the Ultimate Value community.

Sincerely,

Clark Square Capital

Odds & ends

Before we get into the performance review, I wanted to mention a few things:

Check out the most recent idea: If you missed it, I published a new idea in mid-December. Be sure to read it here.

Trials: I think it’s important for my readers to be happy with the content before they subscribe. For this reason, trials are still available upon request. Email me from your work email, and I will set you up.

Chat feature: I encourage you to check it out if you haven’t already (link below).

Share your ideas: Lastly, if you have an exciting off-the-radar investment idea, you can pitch it to me. If I end up writing it up, I will give you credit for the idea and a free one-year subscription. I would love to hear your ideas, so please email me at info@clarksquarecapital.com.

Performance

In 2025, I published 12 actionable ideas and covered numerous updates for existing positions.

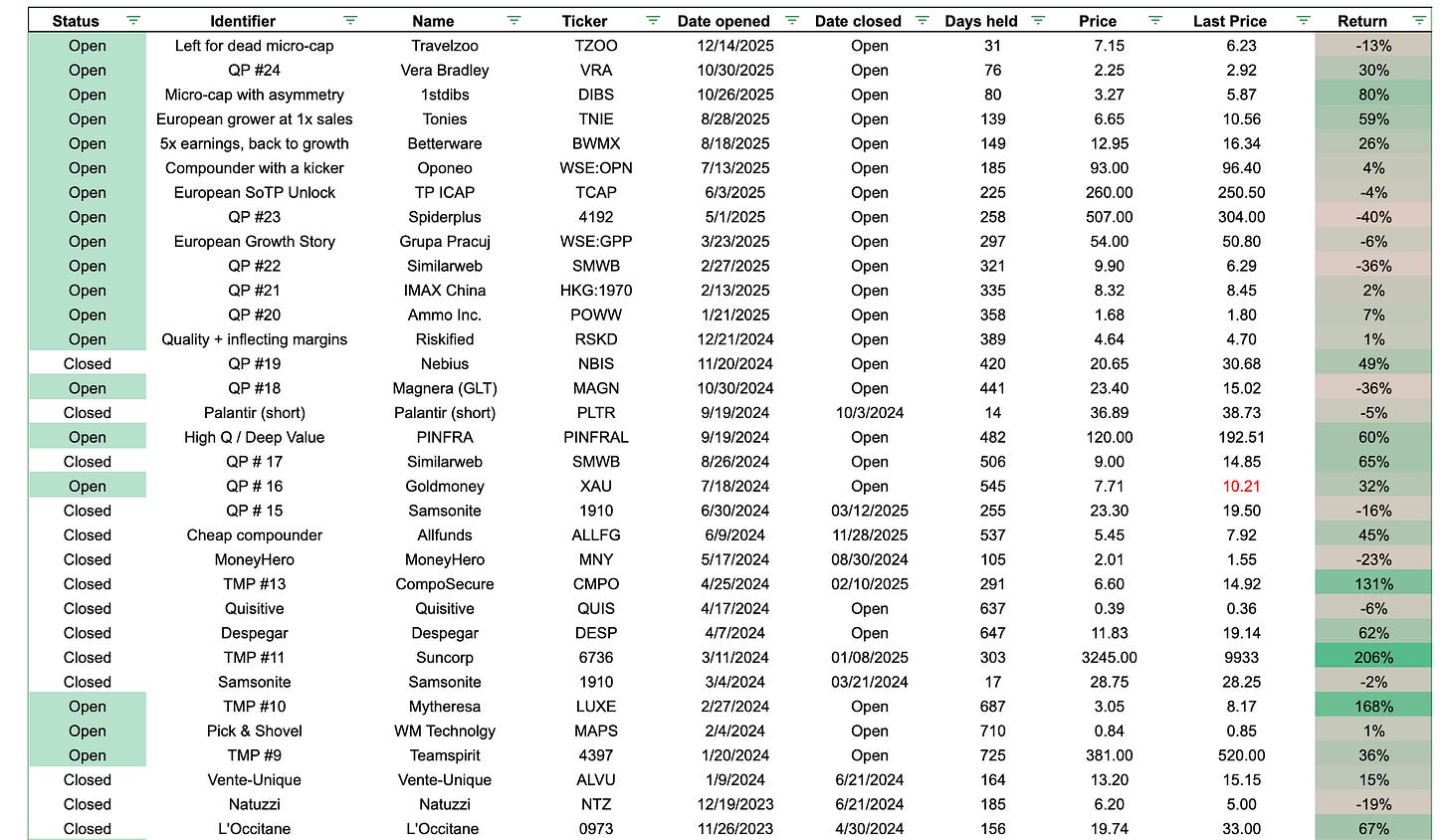

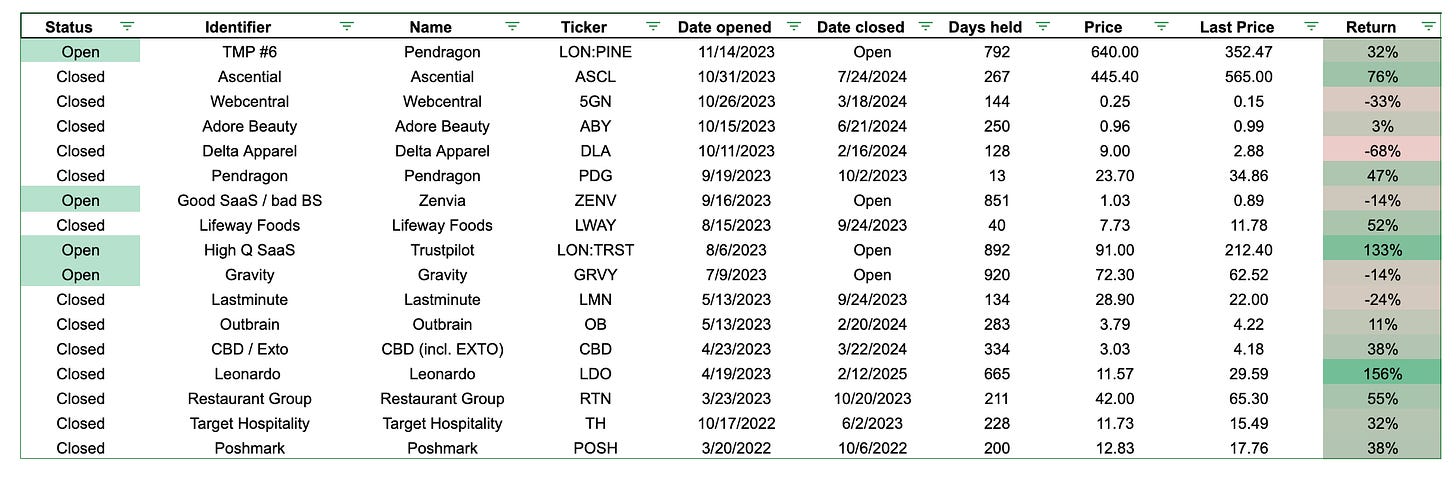

Our performance for the 2025 ideas was underwhelming. The average idea shared in 2025 returned 32%, while the average loser lost 16%. Across all names, our stocks were up ~9% for the year. [Note: these numbers are as of today, since I am relying on Google Data for its ease of use/simplicity. If looking at a hard 2025 stop, performance would be slightly worse.]

2025 was a challenging year. I felt out of lock-step with the market for most of the year. In my own account, I made too many mistakes. I spent too much time focused on the macro and on headlines, instead of focusing on what I’m good at: turning over rocks. I hope to change that in the coming year.

Historical performance, however, remains solid. Across all three years of writing this Substack, 66% of ideas shared have had positive returns — the average winner has returned 55%, and the losers have lost 21% on average. The average holding period has been roughly a year (340 days). Across all ideas, the average return has been 44%. Overall returns have been good thus far.

With that said, let’s take a look at some highlights for this year.

The most significant performance detractors this year include:

Spiderplus (Japan: 4192) — I wrote up Spiderplus back in May. The stock is down ~40%. The company’s results have been disappointing over the past several quarters as revenue growth has decelerated from ~30% to a high-teens rate (ARR decelerated to a low DD rate) due to prolonged sales cycles and a front-loading of customer guidance/education ahead of new service launches.

Similarweb (US: SMWB) — I wrote up Similarweb back in February (for the second time). The stock is down ~36% since. SMWB had a very strong Q2 report with accelerating top-line, but followed with a weaker Q3 (decelerating to ~11% growth from 17% in Q2). The SaaS space has also de-rated significantly due to fears that AI will disrupt or commoditize the industry.

Magnera (US: MAGN) — I wrote up MAGN back in October of last year, before the merger of GLT/BERY was completed. The stock has not worked out well so far — it’s down 36% from where I pitched it. Since the companies merged, MAGN has faced a more challenging fundamental backdrop, with declining volumes and pricing pressures, although free cash flow generation has been better, and the company has reduced leverage to 3.8x turns.

On the positive side, the best performers this year include:

Vera Bradley (US: VRA) — VRA is up ~30% since I pitched in late October. The story remains interesting, with a brand in the early innings of a turnaround. The stock has substantial downside protection, with a liquidation value above the current trading price.

Tonies (Germany: TNIE) — I wrote Tonies up in August and benefited from lucky timing, as the company unveiled its much-anticipated Toniebox 2 just before the holidays. In addition to growing interest in geographies such as the US, the company has benefited from the hardware refresh cycle for the Toniebox. The stock is up ~60% since I pitched it.

1stDibs (US: DIBS) — Another lucky timing one. I wrote up 1stdibs in late October, and the stock has since risen ~80%. DIBS was a no-brainer given that the stock was trading at roughly the value of its cash, despite being a nice little niche platform. The stock has since re-rated but remains cheap at 1x EV/sales.

Here are all of the ideas I’ve shared thus far:

Regarding what is within my control, I did not measure relative to the last two years of publishing. In 2025, I wrote up ~12 ideas and numerous updates, but it's a far cry from the year prior, when I shared 19 ideas.

What to expect for 2026

For 2026, the aim again is to deliver at least 10 actionable ideas.

I expect to publish more ideas than that, but I will give myself some wiggle room to account for a more difficult (i.e. expensive) market.

For this coming year, I want to prioritize shorter pitches to increase idea velocity and find ways to continuously upgrade the portfolio.

While I have no idea what 2026 will bring, I will continue to look for off-the-beaten-path opportunities in the market, and I hope you will join me on this journey.

Best wishes and happy hunting in 2026.

Clark Square Capital

Great stuff CSC!

Keep up the great work!