Five times earnings and back to growth

Cheapest stock listed in the US?

Hello, Ultimate Value readers.

I am back with a new idea.

Trading at ~5x 2026E earnings, and with a chunky dividend, this is one of the cheapest stocks listed in the US market. This company also has decent liquidity, about US $700k per day.

Recently, the company reported Q2 results that were much better than expected, proving to the market that the company still has plenty of growth ahead of it.

Let’s take a look.

Company: Betterware de Mexico

Ticker: BWMX

Exchange: NYSE

Stock price: $12.95

FD Shares O/S: 37m

Market cap: USD 482m

Net debt: USD 254m (~2x net debt to TTM EBITDA)

EV: USD 737mBetterware de Mexico (US: BWMX) [disclosure: I own shares] is one of the leading direct sales companies in Mexico. The company operates by selling products through a network of independent distributors and associates, rather than traditional retail.

The company has two distinct divisions:

Betterware — The original concept. This part of the company is focused on household solutions, spanning home organization, kitchenware, laundry, and cleaning products. All products are designed in-house and sold under the Betterware brand, typically via 12 annual catalogs.

Jafra — Jafra is focused on beauty and personal care, with a product range that encompasses fragrances, color cosmetics, skincare, and toiletries. Jafra was acquired in 2022 for US $255m, financed almost entirely with debt. The company paid roughly 5.5x EBITDA. In the last twelve months, Jafra has generated over $60m in EBITDA.

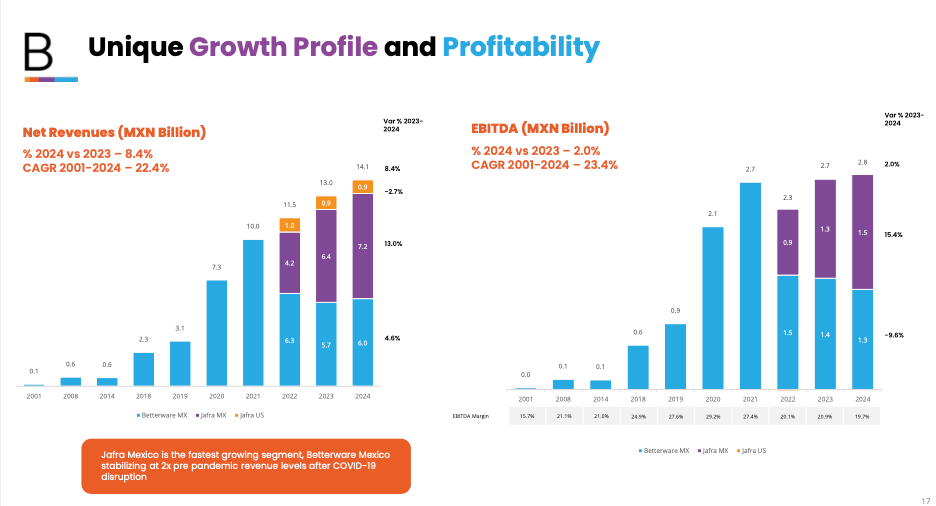

In 2024, the company generated MXN 14,100 million in revenue (USD 750 million), 2,774 million in EBITDA (22% margins), and 1,219 million in net income (8.6% margin). This was achieved through a base of 700k associates and 43k distributors.

The company came to market in March 2020, and Betterware was listed on the Nasdaq via a SPAC merger (DD3 Acquisition Corp.).

How does the company make money?

Betterware uses a two-tier network of independent distributors and associates to sell its products. Distributors and associates purchase products from Betterware at wholesale prices and resell them at suggested retail prices to end consumers, through their networks, catalogs, home parties, and increasingly through digital channels (social media).

BWMX generates revenue through wholesale sales to its network, with sellers retaining the retail markup (typically 20-40%) as their commission. To drive growth, Betterware offers bonuses, incentives, and recruitment awards.

Betterware is a product-centric direct sales company that emphasizes product sales over recruiting. This is important for the model’s long-term health and viability. Jafra operates similarly, although the company operates with more tiers.

Background context

The COVID-19 pandemic was a massive boon to the original Betterware business (pre-Jafra acquisition), as Mexicans sought to supplement lost jobs and wages through alternative means, such as selling Betterware products. Associate/distributor count almost tripled in 2020, with sales growing at a similar pace, particularly as Betterware’s products, home goods, were relevant during that time (i.e., everyone staying at home).

Over the last few years, however, Betterware’s operations have struggled as associates and distributors continued to churn.

The graph below captures the issue well. On the left-hand side, we can see the company’s revenue for Betterware is substantially below 2021 levels. The purple shows the revenues from the company’s acquisition of Jafra.

So why is the stock interesting? I think Betterware is compelling here for a few reasons:

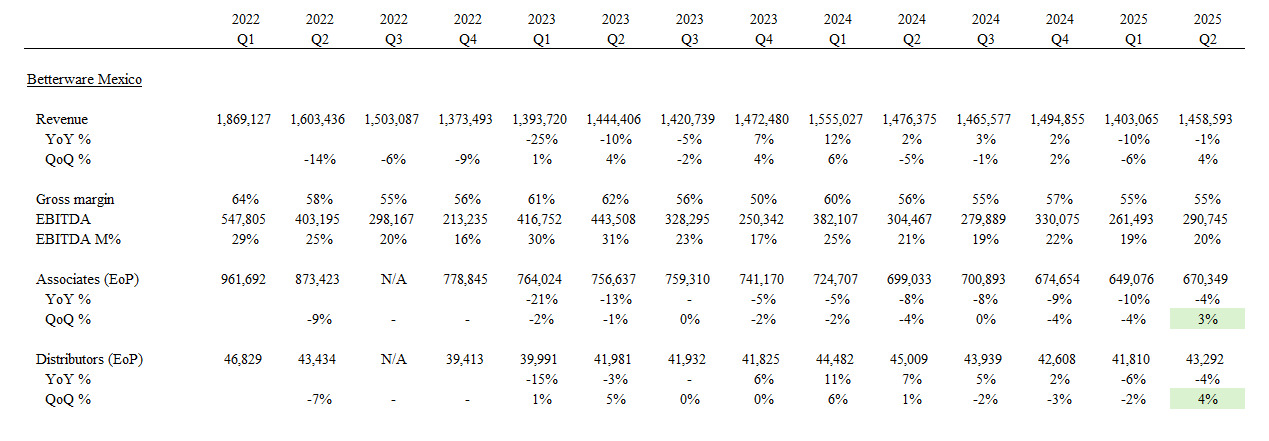

Core Betterware is back on track. After a long COVID-induced hangover, the company is growing its salesforce again.

In the recently announced Q2 2025, the company achieved net associate growth for the first time since Q1 2021, expanding from 649k to 670k associates, or 3.3% growth quarter-on-quarter. The company’s distributor base also grew 3.5%.

Growing the salesforce indicates that the model has finally stabilized (Betterware had grown sales in 2024, but not associates/distributors). When this happens, it begins a self-reinforcing cycle; as the sales force grows because it’s having success making sales, they bring on more people who will begin to sell, who then bring on more people below them. That’s why it’s important to have operating momentum in a direct sales company.

Why was the company able to grow again? A few things. First, the company strengthened the incentive program to drive further associate recruitment. This is beginning to increase the acquisition rates, which has resulted in the first quarter of quarter-on-quarter growth. Second, BWMX noted a modest consumption rebound in Mexico after a tumultuous first quarter. Third, the company has revised its product lineup to make new products more affordable and introduce simpler SKUs.

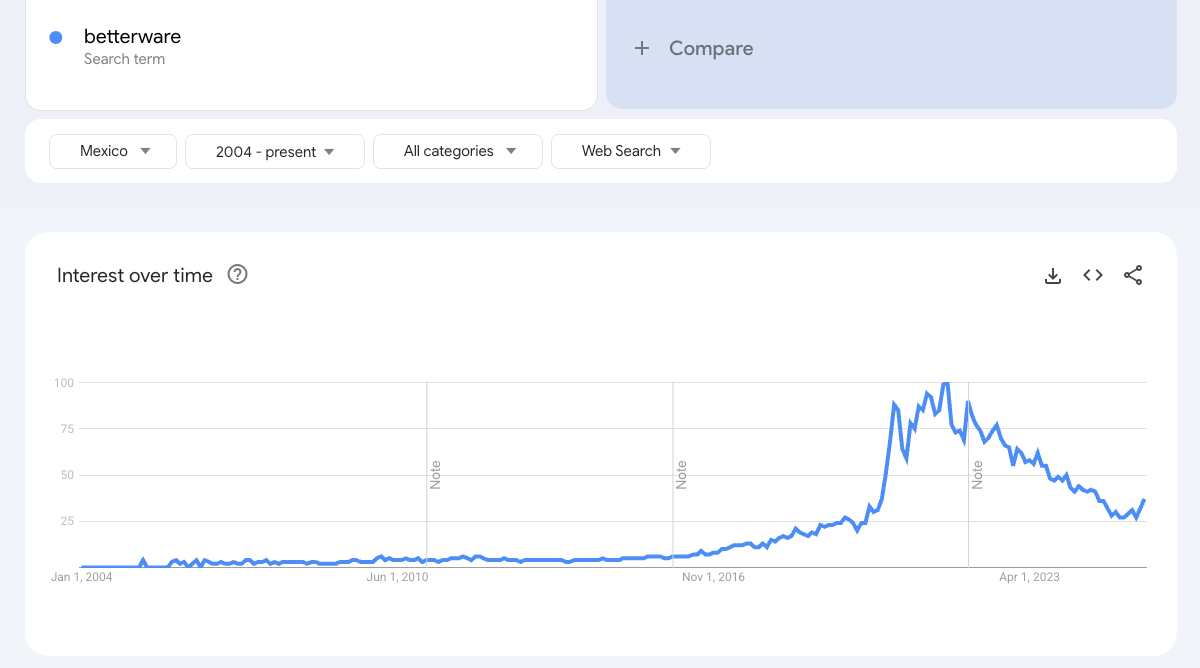

So far, these initiatives seem to be working, as can be seen from search interest trends below. It remains to be seen what the normalized growth rate will be, since the company has been undergoing a period of digestion since 2021.

Before the pandemic, Betterware grew associates/distributors at a 39% CAGR over the 2016-2019 period. While I don’t expect the company to grow at this rate in the foreseeable future, I think it illustrates how rapidly it can grow when it has the proper momentum behind it.

Continued growth of Jafra

Jafra, since its acquisition in 2022, continues to execute. Jafra has been growing top-line at a healthy clip, a 13% CAGR since its acquisition, with EBITDA growing slightly faster. I expect Jafra will continue with its positive momentum.

Earnings will likely grow faster in the back half of the year, as the company benefits from margin tailwinds.

In the last earnings call, management made the case for improving margins, particularly for Betterware Mexico. Management thinks they can get back to 23-25% margins for Betterware, primarily for three reasons: 1) the company buys Betterware products in US dollars, so they benefit from a stronger peso (which has strengthened from a low of ~21 MXN per USD in January, to about 18.70 currently), 2) freight costs from China continue to come down, and 3) the company has redesigned products to fit lower price points but has reduced promotions (will benefit from higher margin sell-through).

I estimate that Q2 positions the company at a current run-rate of EBITDA right in line with management’s annual guidance (MXN 2,900 million) if the company can hit its higher margin target for core Betterware.

The business model is underappreciated.

The direct sales model often faces skepticism. The main criticism concerns its relevance in the digital age. However, the reality is that it will likely remain a key sales channel in Mexico and other emerging markets.

Why? A few reasons. First, Mexican culture emphasizes personal relationships, which makes the face-to-face model of direct selling more effective. Second, the direct selling industry offers flexible employment opportunities, especially for women (who make up about 80% of sellers) and those in the informal economy. Third, direct selling companies have adapted by integrating digital tools, ensuring they stay relevant in a more tech-savvy market.

So, how does this direct sales company compete against Amazon, MercadoLibre, or established retail? For Betterware, each product is unique to the company. The company also maintains a quick pace of new product introductions to keep the product assortment fresh.

For both Betterware and Jafra, the approach is a personalized shopping experience; for instance, an associate can recommend a specific product, which can be effective for products like cosmetics (Jafra’s in-home demos) or housewares (showing how a kitchen gadget works). Moreover, BWMX tends to have a large base of associates and distributors that cover a large part of Mexico, particularly where it is harder for e-commerce and/or traditional retail to reach (i.e. rural Mexico, etc.).

From an investor’s perspective, there’s a lot to like. The company is asset-light; manufacturing is outsourced, and the main corporate assets are its IT systems and logistics center in Guadalajara. The company requires little in incremental CAPEX to grow, which means that the company generates substantial cash flows that will be returned to investors in the form of dividends, debt paydown, and (possibly) accretive M&A.

The valuation is compelling.

Betterware is trading at 6x earnings on my 2025 estimate, and at 5x earnings on my 2026 numbers. While the management’s guidance appears somewhat aggressive, primarily due to the weak Q1 results, I believe they should be on target if you look at the run-rate Q2 revenue and assume they can achieve their ~23-25% EBITDA target for core Betterware.

So what is this worth?

There are many levers to pull in this business (associate growth, productivity per associate, discounts, etc.), making it a difficult task to be precise. With that said, I am forecasting 2025 EBITDA to be below the company’s guide (MXN 2,800 million), given the difficult Q1. I model 2026 EBITDA growing ~10% from the current Q2 run-rate (~roughly MXN 2,900 million), which gets me to MXN 3,200 million. This equates to MXN 46 in EPS or about $2.45 in USD.

I believe the company is worth at least 8-10x earnings, particularly given the reacceleration. At 8x 2026 earnings, the stock is worth $20, and at 10x, the stock should be worth ~$25. This would represent about 50% to 90% upside from the current price.

In the interim, BWMX currently pays out a chunky dividend. Annualized, the dividend is approximately ~9%, although the company reduced it in Q1. If the company returns to its normal payout of MXN 250m per quarter (which should be doable), the dividend yield could be as high as 11% on the current price.

Putting it all together, we have a company that is returning to associate/distributor growth after a long period of digestion. The play here is simple: as long as the sales force is growing, you want to own the stock for a potential re-rating. The stock is extraordinarily cheap and has a nice dividend that will pay you while you wait.

LONG BWMX.

Please feel free to drop a comment or question below. Thanks for reading!

Did you do work on the new incentives, and whether the rebound in distributors is sustainable? If this doesn't grow, 6x p/e does not seem that undervalued given their dd CoD.

Fundamentally Why do you think an mlm company is a good business? I get very concerned about the churn and the mote given that the salesforce reacts to incentives that seem like they’re easily changed