More thoughts on TMP #10

Dear Ultimate Value readers,

I started writing a general update post, but my thoughts on Mytheresa (US: MYTE) started getting too long, so this has become an update for MYTE only.

Let’s take a look.

A few weeks ago, I highlighted an opportunity to size up our Mytheresa (US: MYTE) position just as the company announced a deal to “acquire” (steal) YNAP from Richemont.

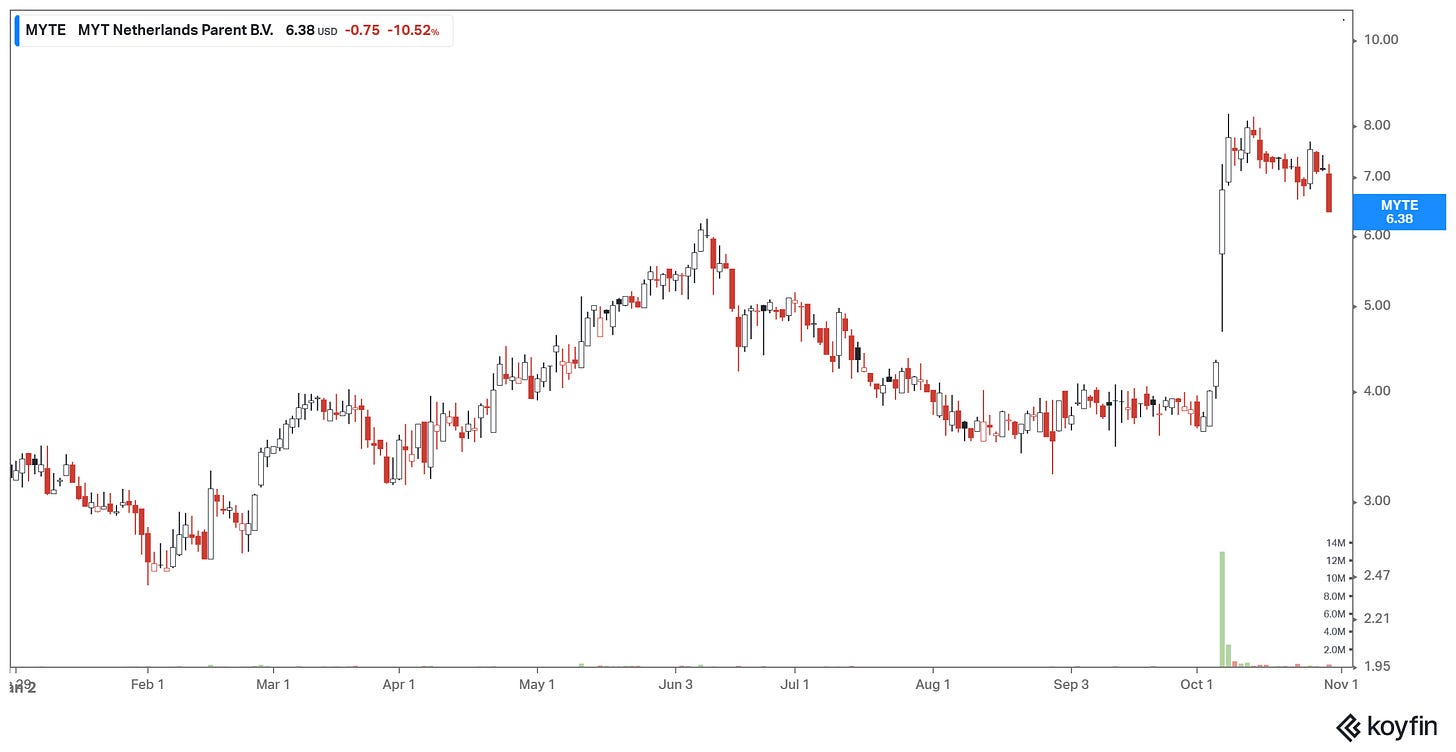

The day the deal was announced, the stock began trading at a significant discount ($5-$6) to what I thought it was worth. Ultimately, it increased to ~$8 per share, but still below my near-term target of ~$10.

MYTE has given back some of these gains in the last few days. At $6 and change, I believe the stock is significantly mispriced again and worth a closer look.

I am sharing a few more thoughts on the company in case they are helpful. Please refer to the previous posts (original write-up and “pounding the table” below).

If you are new to the story, MYTE is a leading luxury e-commerce company that caters to high-end clients. The original buy thesis centered on four key points:

GMV/sales started to re-accelerate after Q2, growing at a double-digit rate.

Free cash flow generation would start to inflect as the company: a) finished building out a distribution center, b) the company worked down inventory to 260 days (from 300+), and c) SBC would come down meaningfully as a large stock grant (which was expensed over 4 years) came to an end.

MYTE would benefit from a much better competitive landscape (a capital cycle?) as competitors went bankrupt or were acquired (i.e., Farfetch/Coupang).

The stock was cheap — 0.4x EV/sales, 0.6x EV/GP, ~8x EBITDA.

While the original story was quite interesting, MYTE became a much better opportunity when it announced that it would acquire YNAP.

If you recall, the YNAP acquisition was a fantastic deal for Mytheresa. MYTE receives Yoox Net-a-Porter (YNAP) and EUR 555m in cash from Richemont. In exchange, Richemont will get a 33% stake in MYTE post-deal.

In my “pounding the table” post, I laid out my high-level thoughts on valuation in the near term.

If you assume that MYTE+YNAP trades at the same multiple that MYTE did pre-deal (0.4x EV/sales), and you ignore the EUR 550m in cash (as the losses will get capitalized), then this should have a significant upside from here (3,000m in sales *0.4x EV/sales = EUR 1,200m / 135m shares = EUR 8.90 per share, or roughly a $10 stock).

In the medium term (2-3 years), if MYTE can execute and achieve the ambitions it laid out in the M&A deck of EUR 4B in GMV/sales at >8% EBITDA margins, I think the stock could be a home run—perhaps worth >$25 per share (4,000m in sales * 8% EBITDA margin * 10x EBITDA multiple = EUR 3,200 / 135 shares = EUR 24 per share, or roughly $26 in USD).

Without further ado, here are some of the points of pushback I’ve gotten from investors and my thoughts on them.

YNAP is burning too much cash to give MYTE credit for the EUR 550m benefit.

The stock doesn’t require much cash to work (as highlighted above). However, the cash bleed could be less severe than investors expect.

First, given the duplicative costs between MYTE and YNAP, the combined companies should have a healthy amount of synergies. MYTE management did not call out a synergy target, but it’s likely that a good chunk of YNAP’s SG&A can be cut; there will also be savings on advertising and shipping/warehousing. Most M&A deals tend to pencil ~2% of combined sales for synergies. In this case, that would amount to ~EUR 60m.

If you look back at YNAP’s old financials (before Richemont) from 2017, the company was similar in scale to today. Back then, it spent almost EUR 200m on SG&A, so it’s not too much of a stretch to think that EUR 60m or more can be cut.

Second, let’s take a quick look at YNAP’s most recent numbers from the Richemont annual report (share below).

We see that cash burn has been trending in the right direction for FY24. Readers will quickly spot an issue—inventories are crazy high (almost EUR 1B!!). But here lies an opportunity. Assuming that YNAP can lower its days’ inventory to 260 (the same target as MYTE), you get an unwind of at least EUR 100m (even assuming 10% top-line growth). Similarly, if MYTE can hit its 260-day goal, we could see a ~EUR 40m benefit.

Third, in the M&A presentation, MYTE management mentioned that Net-a-Porter and Mr. Porter, which have EUR 1.2B in GMV/sales, operate at a LSD EBITDA margin. This likely means that this part of the business is roughly FCF breakeven. So, most of the cash flow problems come from Yoox and The Outnet.

Quite tellingly, MYTE has decided to keep this part of the business separate (see below). Given this strategic choice, it wouldn't be surprising to see MYTE eventually selling or winding down this business, which would go a long way to helping YNAP’s cash flow issues.

Between the working capital benefit (EUR 140m) and MYTE’s earnings in FY25 (I estimate ~EUR 40m in EBITDA), you can see how some of YNAP’s 200m losses can start to get offset. Synergies might take some time, but they will also help close the gap.

Ultimately, it’s not a stretch to think that MYTE might get to keep some of the cash from Richemont. Assuming MYTE can keep EUR 200-300m, this could add another USD 2-3 per share in fair value.

Richemont essentially gave YNAP away because it has little to no value.

One investor argued that YNAP must have little value since Richemont essentially gave it away.

I think differently here. MYTE was able to get a fantastic deal for a few reasons.

First, let’s set some context. Richemont and YNAP were a poor fit together. Richemont essentially bought YNAP to help bring its brands to the digital forefront, as this excellent piece by The Fashion Law suggests:

A read between the lines (plus a bit of hindsight) suggests that Richemont leadership was looking to use YNAP mainly as a way to sell the products of Richemont-owned brands on the web. And this may have come at the expense of investments in and advances for YNAP as a standalone company, particularly since it “became clear” in the wake of its initial investment in Net-a-Porter that Richemont “acquired little knowledge about the mechanics of digital,” according to GAM’s luxury brands investment strategy manager Flavio Cereda.

With very different cultures, insufficient investment, and no synergies between them, it’s not surprising that YNAP was a disaster. Given the mounting losses in the YNAP segment, investors like Bluebell—an activist fund in Europe—pressured Richemont to divest it.

Secondly, Richemont had already tried to get rid of YNAP by selling off a controlling stake to Farfetch. Ultimately, this failed as Farfetch became financially distressed and was eventually acquired by Coupang.

Third, while private equity firms took a look at YNAP, reports suggest that they were hesitant to pull the trigger due to the losses. Unlike MYTE, PE funds could not extract much in synergies, etc. Ultimately, they walked away from a deal to MYTE’s benefit.

Put together, the conditions were perfect for MYTE to get one heck of a deal.

You don’t want to own luxury in this environment.

It’s been a challenging environment for luxury. Recently, Kering reported results that were significantly weaker than expected. LVMH’s fashion and leather segment also missed expectations.

Kering, for instance, commented that Europe and the US were roughly stable in Q3. LVMH mentioned in their F&L results: “We have a slight improvement in the U.S. We have a slight improvement in Europe, but there is nothing to write home about, to be frank.”

It’s clear that China has been the primary source of weakness for many luxury companies. Fortunately, MYTE has little exposure to China, and YNAP recently closed its Chinese operations.

Moreover, despite the industry's doom and gloom, Mytheresa has been performing well, with sales and gross profit growing at double-digit rates.

MYTE’s position in the industry has also improved considerably. In the original write-up, I commented:

Recent news stories suggest luxury brands are skittish about Farfetch’s future under Coupang’s ownership. For the most part, Coupang is not seen as a good fit for FTCH’s luxury partners since Coupang is an Amazon-like player focused on lower-priced goods.

There are signs that luxury players are uneasy with Farfetch’s new ownership. For instance, Kering (Gucci, Balenciaga, Saint Laurent) ended its contract with Farfetch earlier this month, worth ~$100m of GMV. Consequently, Neiman Marcus also announced that it had abandoned plans to use Farfetch’s e-com software unit, FPS.

In this turmoil, I think MYTE is well-positioned to benefit. MYTE is seen as a serious partner to these high-luxury brands, given their policy of running full-priced sales and having skin in the game through inventory risk.

One positive from the Farfetch/Coupang tie-up is that some rationality might return to the industry and end Farfetch’s more aggressive discounting, which will benefit MYTE.

As we continue to see these signs of industry rationalization, I think MYTE will be even better positioned, particularly as they merge with YNAP to create an even more significant presence in the industry.

The MYTE opportunity looks attractive, particularly given the recent price weakness.

In the upcoming weeks, we will hear from MYTE— for earnings on November 19th. Management will also be speaking at four conferences in the next two months:

J. P. Morgan Global Luxury & Brands Conference in Paris, November 13, 2024

BofA Global Research EMEA Consumer & Retail Conference 2024 in Paris, November 14, 2024

TD Cowen OC's Luxury Day in New York, November 20, 2024

Morgan Stanley Global Consumer & Retail Conference in New York, December 3-4, 2024

I expect we will start hearing more thoughts on the YNAP merger (synergies?), which might be a positive catalyst for the share price. In the meantime, I remain LONG.

Thanks so much for reading!

1. How is this better than failed Farfetch?

2. I think Luxury is less not an online business. I'll re-read this.

Hi CSC, Really interesting write-up and appreciate your detailed work here. To me it seems like a major assumption to assume Days of Inventory at YNAP could decrease from 343 to 260 in such a short space of time. I accept that the two companies are now more alligned together than YNAP was when a subsidiary of Richemont but this still seems a stretch to me especially over the next 12 months. Have you made this assumption based off anything in particular here that I could be missing? It seems a large part of the WC benefit (~100m Euro odd) is being attributed to this occurring so just trying to get a better understanding here as to how realistic this truly is? The 560m Euro cash being provided by Richemont could more or less be blown through within 2 years here if we don't get any major WC benefits or see meaningful sales growth, so doesn't the thesis fall apart here if your assumed WC benefits don't occur over the next 12-24 months? I understand that you may argue no it doesn't because the EV/Sales valuation is still wildly too low but if management cannot steer the YNAP ship in the right direction then why should/would the market re-rate this as it continues to heavily bleed cash?