Quick Pitch #17

Cheap SaaS business with solid operating momentum & inflecting earnings

EDIT: Closed this out at $14.85 (+65%) on January 8th, 2025.

Hello, Ultimate Value readers!

I am back with a new idea today. Here are some of the takeaways:

The idea is more suitable for small funds, given an ADTV of ~$1.2m.

Revenue has accelerated three quarters in a row, and next Q’s guidance suggests further acceleration.

The company is adjusted EBIT profitable and FCF positive. It improved margins by 40 points over the last two years while growing top-line LDD.

The company trades at 2.5x 2025 ARR, below SaaS peers despite a better margin and growth profile.

Let’s take a look.

Company: Similarweb

Ticker: SMWB

Exchange: NYSE (USA)

Stock price: $9.00 (Aug 26)

FD Shares O/S: 88m (79m S/O + vested options & RSUs)

Market cap: $795m

Net cash: $62m

EV: $733m

ADTV: $1.2mSimilarWeb [disclosure: I own shares] is the leading digital intelligence platform (think Nielsen, but for digital). The company provides insights into website and app traffic, audience behavior, and market trends. SimilarWeb offers various tools and data to help businesses understand their competitors, identify growth opportunities, and make data-driven decisions. The company generates revenue through subscriptions typically sold in yearly or multi-year plans.

SMWB was founded in Israel in 2007 by the current CEO, Or Offer, who still owns 8% of the company. It IPOed at $22 per share in May 2021. The company generated $218m in revenue this past year and lost $5m in adjusted operating income.

At its core, Similarweb is a data business. The company collects data from millions of websites/apps from four primary sources: 1) first-party direct measurement (data from owners that choose to share directly), 2) contributory network (apps/plugins that track anonymous behavioral data), 3) public data from millions of websites, and 4) data partnerships with ISPs, DSPs, and other consumer/internet websites.

SMWB offers products tailored to industry needs, including research, marketing, sales, and investing. Research and marketing products account for the majority of revenue, with about 65% share.

Ultimately, I think SMWB has a more defensible business than meets the eye, due to:

Significant barriers to entry — SMWB is one of the few scaled players with proprietary data and exclusive data partnerships. Given the investment and time needed, a new entrant would find it very difficult to recreate this.

Strong ROI for users — Rapid user growth in the current environment demonstrates that customers find value in the product. In a tougher macro, the company can likely benefit as companies “double down” to get market data to understand their positioning (as noted by the CEO on the Q2 call).

Why is this mispriced?

There are a few reasons why I think the opportunity is mispriced.

First, the company is trading well below its IPO price of $22 per share as growth decelerated following the COVID pull-forward of demand.

Secondly, the company is Israeli, and most Israeli companies tend to trade at a discount to US-domiciled SaaS companies; sometimes, the discount is merited given governance concerns, but that should not be the case here.

Third, the shares are not particularly liquid. The average daily traded volume is only about $1.2m daily, making it hard for funds to build a position.

I think Similarweb is a compelling investment for the following reasons:

Similarweb revenue growth has inflected over the past several quarters and is set to accelerate further into the back half of the year.

Similarweb was a big winner during COVID and came to market growing top-line at a fast clip, roughly at +50% YoY. Growth eventually slowed and troughed in Q3 2023 at +10% YoY. Over the last three quarters, SMWB has accelerated topline to +11% / +12% / +13% growth and is guiding Q3 2024 to +15% growth.

I expect revenue to grow at a mid-teens rate, if not faster. Here are the reasons why I think revenue can likely continue to accelerate from here:

Top-line growth has been driven by new customers, which grew at +17% YoY this last quarter. ARPU has been a slight headwind (-3% YoY) as the company released a revamped package and pricing model called Similarweb 3.0, which has been dilutive to ARPU. As the company anniversaries the rollout of this in Q3 2024 and ARPU either flattens or returns to growth (as is typical with the land and expand model), I expect revenue to grow at least in line with customer growth.

During the last call, management mentioned that they expect further improvement in net revenue retention (currently at 99%, but with enterprise at 109%). Decreasing logo churn or increasing ARPU will result in a nice lift to revenue growth.

RPO also accelerated to +24% growth in Q2. This should bode well for future revenue growth.

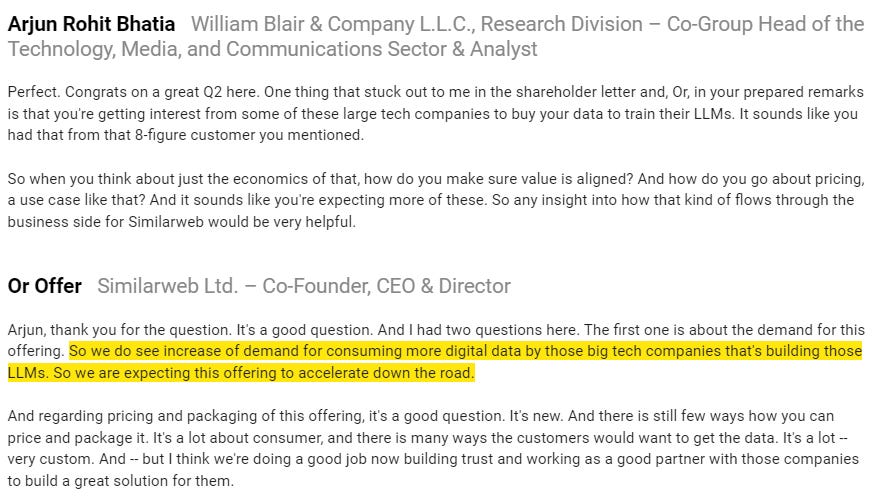

In the Q2 24 earnings call, the company noted continued demand from tech companies using its data to train large language models (LLMs). This last quarter, it signed its first 8-figure deal (implying at least $10m). You can see this momentum in the Q3 guide, indicating the fastest QoQ growth since 2022. Management noted that they continue to see significant interest in these types of deals.

Management began to speak to “becoming a rule of 40 company” as they reached adjusted EBIT profitability. The company aggressively cut down costs in 2022/2023 to reach breakeven, taking sales & marketing from a mid-60s percentage of revenue to 36% in Q4 2023. As they have shown that they can be a profitable business, management is now focused on driving ‘profitable’ growth and will be able to reinvest some margin to drive faster sales growth.

SMWB has demonstrated significant operating leverage and cost control, taking EBIT margins from -33% in 2022 to +8% in 2024E. As the company reaches GAAP profitability, I expect shares to re-rate.

SWMB has successfully demonstrated to investors that it can be profitable, cutting expenses by 40 points and still growing at a LDD rate.

SMWB is now adjusted EBIT profitable, although still slightly loss-making on a GAAP basis. I expect the firm to reach GAAP profitability in the next couple of quarters. In Q2, the company lost $1m (-2% GAAP EBIT margin).

In the medium to long term, the company is guiding to 25% operating profit margins, which translates to roughly ~30% EBITDA margins.

Now that the company has shown profitability, it is focused on accelerating growth and reaching “rule of 40” status.

The stock is very cheap. SMWB is trading at 2.5x 2025 ARR/sales and 2.1x 2026, well below peers despite a better margin and growth profile.

The median US SaaS company has the following characteristics: trades at 5.3x NTM sales, with NTM growth of ~11%, gross margins of 75%, operating margins of -10%, and net revenue retention of 110%. Except for NRR, in which SMWB is lower than peers — at 99%, but with enterprise clients at 109% — SMWB has better metrics than the “median” SaaS business. SMWB is a bit of an odd duck — more a data business than pure software — but it does highlight the stark valuation disconnect.

SMWB will likely grow top-line at a mid-teens rate and deliver ~2 pts of EBITDA margin expansion annually, which means earnings/FCF compounding at +30% per year for the foreseeable future. This will be mainly driven by expanding gross margins—management targets 85%—and leverage from G&A and R&D spending, which need not grow proportionally with revenue growth. In the medium to long term, management thinks the business can reach 25% EBIT margins—or roughly 30% EBITDA margins.

Perhaps a closer pure comp is SEMrush (US: SEMR), which trades at 4.4x NTM EV/sales. SEMR is growing faster than SMWB (+20% in ‘24, high teens in' 25) but has a similar margin profile. SEMR has a valuable niche in search engine marketing but is more focused on serving SMBs than enterprises vs SMWB.

As the company continues to execute and revenue accelerates, I think the sales multiple can re-rate 1-2x turns from here (to 3.5-4.5x EV/sales).

Valuation & Model

My 18-month price target is $14 per share for an upside of ~60%. Over an 18-month period, this would represent an IRR >40%.

I value SMWB at 3.5x forward EV/sales multiple based on my 2026 sales estimate of $343m, using 2025 year-end cash and a diluted share count of 91m (which assumes ~3% yearly dilution to account for $20m in SBC per year).

A 3.5x EV/sales multiple imputes a 22x multiple on 2026 EBITDA — although this would be at an EBITDA margin of 16%, far off from the company’s ~30% margins at maturity. On steady-state margins, this would be closer to 12x EBITDA.

The 3.5x EV/sales multiple is supported by SaaS peer valuations (recall the median trades at 5.3x) and SEMRush at >4.0x. I wouldn’t expect SMWB to trade in line or at a premium, but I expect the current gap to narrow over time.

I think SMWB could support a 4.5x EV/sales multiple if you assume a 15x EBITDA steady-state multiple at mature margins of 30%. Getting to 4.5x EV/sales would mean you clip a "sales growth” return, which might equate to a low to mid-teens return for years. This seems like an adequate return for the incremental buyer.

At a 4.5x EV/sales multiple, the stock could be worth $18 — a double from here.

Catalysts:

Continued quarterly earnings reports showing an acceleration in revenue/earnings.

Large client wins from mega tech companies using data to train LLMs.

Risks:

A slowdown in corporate spending could pressure revenue growth / NRR.

I could be wrong about the valuation—the market could continue to apply a large discount because the company is Israeli and not a “pure” SaaS name.

Thanks so much for reading! In the comments below, let me know if you have any thoughts, questions, or feedback.