The Restaurant Group ($RTN.LN)

Egregiously cheap with improving fundamentals and activists circling

The Restaurant Group PLC

Investment Thesis – Summary

The Restaurant Group is a UK hospitality operator with a portfolio of businesses spanning fast-casual restaurants (Wagamama), pubs, leisure (casual restaurants), and concessions (i.e. food at airports). Over the past 5+ years, the stock has been a disaster as RTN suffered through mandatory closures during COVID as well as eroding margins from inflationary headwinds (higher energy prices, higher food costs, higher labor costs). Moreover, the current management has a history of poor capital allocation, having diluted equity holders with three equity raises (raising c. 550m GBP) over the last five years. This has resulted in a stock price that is down c. 75% over the time period, and RTN has trailed both food/leisure peers as well as the FTSE All-share index.

Despite this, I think that The Restaurant Group PLC is incredibly compelling at the current price of 0.42 GBP/share. RTN is one of my favorite types of setups: a couple of high-quality assets (Wagamama + pubs) with improving fundamentals and potential near-term catalysts that are likely to crystallize value. In short, there are multiple ways to win, including through:

Margin recovery (>300bps) as cost pressures abate (food cost, labor, energy) with continued strength in volume given the quality of concepts and improved competitive backdrop (i.e. restaurant closures).

A strategic review / activist pressure that is likely to lead to corporate action(s) to unlock sum-of-the-parts value and/or pay down very expensive debt (>10%) – a move that should create value for equity holders.

A re-rating driven by improving sentiment/interest as the company: 1) refocuses on its higher quality, faster-growing concept, Wagamama; 2) improves disclosures around segment-level profitability, and 3) improves capital allocation due to activist input/pressure.

The current valuation is inexpensive, with RTN trading at 4.2x 2024E EBITDA (pre-IFRS16), ~6.0x EBITDA-maintenance CAPEX, and ~8.2x EPS. The potential sale of the company’s owned pub real estate could also lower the effective multiple by at least a half turn. Ultimately, I think the share price is worth at least 100 pence vs. the current price of 42 pence/share. The downside is well protected by the low valuation and hard asset value (pub real estate); debt is manageable at 2.2x net debt to EBITDA (pre-IFRS 16) and RTN has no maturities until 2027.

Business Background

The Restaurant Group is a UK hospitality operator with a portfolio of businesses spanning fast-casual restaurants (Wagamama), pubs, leisure (casual restaurants), and concessions. An estimated ~2/3 of revenues and ~85% of profits come from the Wagamama and the Pubs businesses.

Wagamama – the most popular pan-Asian restaurant concept in the UK. 2023 sales are estimated at 460m GBP. The normalized EBITDA margin is in the mid-teens range. WG was acquired in December 2018 at an EV of 560m GBP with RTN paying roughly 9x EBITDA post-synergies.

Wagamama UK – owns and operates 153 locations currently (target ~200 potential sites).

Wagamama International – currently franchises 58 locations with a target of expanding this by 7/year.

Wagamama US – owns 20% of the joint venture; currently has 7 locations with a target of 30 by 2027.

Pubs – attractive locations based in affluent areas with relatively limited local competition. 2023 sales are estimated at 130m GBP. The normalized EBITDA margin is in the high-teens to 20% range.

Operates 80 pubs across the UK in upscale areas.

~50% of the Pubs real estate is owned by the company and independently assessed at ~160m GBP.

Other businesses – include casual restaurant concepts and the concessions business. The leisure business has been restructured multiple times in the past five years and the estate has been reduced from 350 locations to ~130. Management plans to continue to reduce locations that cannot generate positive cash flow.

Leisure – owns casual concepts such as Frankie & Benny’s (Italian; 86 locations), and Chiquito (Mexican; 22 locations).

Concessions - 42 airport concession sites located in the UK in airports such as Heathrow, Gatwick, etc.

Barburrito – a recently acquired concept in the UK focused on Mexican food. Has <20 small locations.

Thesis

RTN will recover at least 300bps of EBITDA margin within the next couple of years as cost pressures (utilities, food & drink costs, etc.) abate.

Cost pressures have started to abate meaningfully for energy (natural gas prices are down c.90% from the August peak). While the February UK CPI number came in hot for food prices, I expect that we will eventually see prices come down in the medium term. Moreover, the share of delivery vs. dine-in has declined, particularly in the last couple of months (likely since it’s cheaper to dine in), and should be accretive to overall margins as well.

In the FY22 report, management laid out a target of recovering +300bps over the next 3 years, which is very conservative considering that consolidated margins averaged ~14% prior to COVID. Moreover, the mix has also improved considerably as Wagamama and Pubs have continued to gain share relative to Leisure/Concessions (Wagamama margins in the mid-to-high-teens and Pubs close to 20% margins).

I estimate that margins could recover to ~12% EBITDA by 2024 (from ~8.3% in FY22, adjusted for a temporary VAT benefit) and to >13% by 2025, which means a normalized EBITDA (pre-IFRS 16) of at least 120m GBP.

Wagamama and the Pubs businesses are high-quality assets with a track record of execution and solid unit economics.

Wagamama is a high-quality asset:

Leader in concept – Wagamama is the only UK pan-Asian brand concept of scale.

Solid execution – Wagamama has a history of HSD LFL sales and significant outperformance relative to peers. From 2017 to 2019 LFL growth averaged ~8% (+8pts above peers). In 2022, LFL sales grew 8% again and outperformed the Coffer Peach Index by 3pts. The outlook for restaurants that survived COVID is likely to be good as c. 20% of restaurants closed, and traffic levels are still below 2019 levels.

High returns on investment – new Wagamama locations usually target 35-40% pre-tax returns on invested capital. Wagamama is also attractive for multiple day-parts (both lunch and dinner), which helps drive sufficient traffic/density to generate meaningful returns.

High popularity/satisfaction amongst consumers – Wagamama is a beloved brand in the UK. Independent net promoter score (NPS) evaluations put it at the top of the list vs. other casual concepts - on par, if not slightly higher than Nando’s.

Multiple growth levers – Management targets a 200-location estate in the UK (153 currently) and laid out a plan to grow by 5 stores per year. Their current debt load, however, likely limits them from being more aggressive on expansion. WG also has 58 franchised locations (in the Middle East, etc.) and can grow this valuable royalty stream at little to no incremental cost. Lastly, WG also has a joint venture with a US operating partner (it owns ~20%) that has ambitions to grow its store count from 7 to 30 within the next few years. There is option value if the concept resonates in the US and WG owns a call option to repurchase 80% of the business.

The Pubs business is also a high-quality asset:

Unique value proposition – most pubs operate in remote locations with limited competition and cater to more affluent patrons.

Solid execution – LFL sales have outpaced the competition, with average LFL sales growth from 2017 to 2019 of 4% (+4pts above competitors). In 2022, LFL sales growth accelerated to +10% (+11pts above the relevant benchmark).

Solid returns on investment – new pubs target approximately 20% pre-tax returns on capital.

“Hidden” asset value – RTN owns the real estate for ~50% of pub locations (c. 40 pubs) and states that the freehold assets are worth ~160m GBP (as per an independent evaluation).

Activist involvement is to serve as a catalyst for unlocking sum-of-the-parts value.

Two activists are involved in RTN: Oasis Management (owns ~6.5% of RTN via swap) and Irenic Capital Management (ownership unclear). In mid-February, Oasis pushed for a board seat as well as some governance changes but was rebuffed by RTN. In response, RTN stated that they are currently undergoing a strategic review.

News stories suggest that Irenic Capital has been in discussions with management and has been imploring the company to consider selling the Pubs and concessions businesses, increasing disclosure around segment-level profitability, as well as reducing corporate expenses.

In a sale, I believe that the Pubs business could generate proceeds of ~170m GBP (GBP 0.22/share) at a 7.0x EBITDA multiple. It’s difficult to break out the Concessions business by itself, but in a sale of the Concessions + Leisure businesses, these could also fetch ~70m GBP (GBP 0.09/share). These sales would be more than sufficient to cover most, if not all, of the company’s existing debt.

Given that the company’s annual general meeting (AGM) is coming up in May, I think we are likely to see some progress in the discussions between the company and Oasis/Irenic that potentially pave the way for a simplification of the business.

Improved perception of corporate governance and capital allocation will lead to a re-rating.

Given activist involvement, there are many levers that can be pulled to increase the value of the company.

Improved disclosure around segment-level profitability – this is the easiest lever to pull but should be meaningful. Currently, the company does not disclose individual segment-level profitability (or corporate expenses); segment profitability can be somewhat triangulated with public data, but it would help if investors could easily get the figures necessary to value the parts separately.

Renewed focus on its higher quality, faster-growing concept, Wagamama – WG is the best concept by far, with the best ROIC and a long runway for continued growth. If WG were to trade on its own, it would likely command a higher multiple given healthy LFLs and an outlook for further UK and Intl. expansion.

Improved perception re: capital allocation – having an activist in the stock/board is likely to reassure investors that management will not make capital allocation mistakes such as further dilutive equity raises. Additionally, instead of focusing on distractions - such as purchasing non-core concepts like Barburrito - management can create significant value by paying down its expensive debt through the sale of non-core assets. Eventually, once leverage comes down, the company can repurchase shares and reinstate a yearly dividend, as this could be attractive to the typical UK investor (those guys and gals love dividends).

Valuation

By any metric, the stock is inexpensive. On my 2024 estimates, RTN is trading at 4.2x EBITDA (pre-IFRS16), ~6.0x EBITDA minus maintenance CAPEX, and ~8.2x EPS.

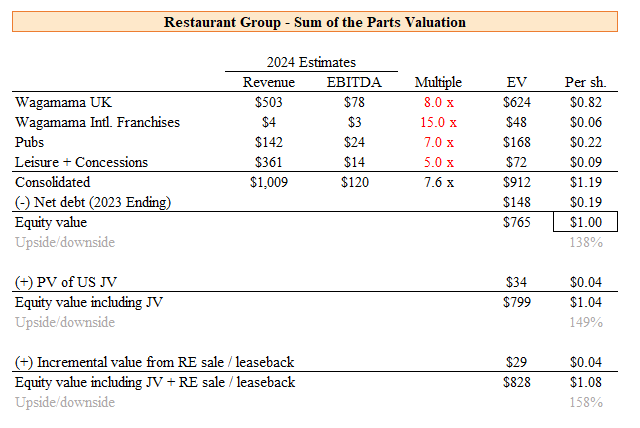

At a ~7.5x blended EBITDA multiple (8x for Wagamama, 15x for intl. franchises, 7x for Pubs, and 5x for the remainder) the equity could be worth ~GBP 1.00/share (+140% upside from current). The company also owns 20% of the US JV, which I estimate is currently worth ~35m GBP (GBP 0.04/share); moreover, a sale-leaseback of the pub real estate could add another incremental GBP 0.04/share in value.

Pubs valuation

Although the company values its pub business at GBP 160m, I decided to haircut that estimate by ~30% as rent costs in the UK have come down post-COVID. At this valuation (GBP ~2.75m per location), it’s not difficult to pencil out attractive returns and you get some upside if this turns out to be too aggressive a haircut.

Summary Model

Any comments/feedback, please write to me on Twitter @clarksquarecap.

Hi Clark,

Great writeup. Very clearly laid out.

Feedback / my thoughts on the idea:

- Margin increase thesis relies on food and energy prices going down soon. I've got no clue. Also need consumer spending to stay high. I suspect some are still in the delayed pent up demand spending and cost pressures will continue to reduce demand gradually maybe? In short just not confident in this.

- Poor management - makes me think the thesis of selling off pubs / concessions is not very likely. At least I wonder how proactive they will actually be. Time frame at the least is very unknown.

- Rebuffing Activist investors board seat request with statement on undergoing strategic review - is this lip service? It's certainly reactive and not proactive - showing poor management again.

Those 3 are enough for me to think it could get worse before it gets better... So a pass for me. Will keep an eye on it though.

Much less relevantly I was a big fan of Wagamama's but last couple of times I've been I've found it expensive versus alternatives. And food was just less good than I remembered. And service much worse than pre-pandemic. My go to for Asian chain restaurant is now Pho. I still like Wagamama's but don't love it anymore, and I / my family are definitely their target audience.

Hope that's somewhat helpful... sorry it's not super positive from me.

Looking forward to your next writeup!

Only found this business last year after they acquired Barburrito, a competitor to a company I own. Thanks for the write up!