Three-minute pitch #5

EDIT: Closed this position out on 7/24/2024 for a 76% gain.

Two days ago, a liquid (~$4m USD ADTV) UK-listed company announced the simultaneous sale of two of its divisions after undergoing a strategic review/alts process. Luckily for us, the company will keep one business in the public markets after paying out >70% of the market cap in cash. Best of all, the current price allows us to buy the remainco for less than half of what comparables usually trade at.

While this is an asset that I think is worth owning, it’s more likely that it will attract interest from a strategic or a PE firm. Given the downside protection from the dividend and solid upside, I think the risk/reward is attractive.

The opportunity we are looking at today is Ascential (UK: ASCL). The stock is a UK-listed conglomerate currently trading at GBP 262 p/share (disclosure: I bought some today at 266p) and a market cap of GBP 1,165m (445m shares outstanding).

Ascential operates three very distinct businesses: 1) product design (WGSN), 2) digital commerce, and 3) events. ASCL also owns 36.5% of a now non-core SaaS business.

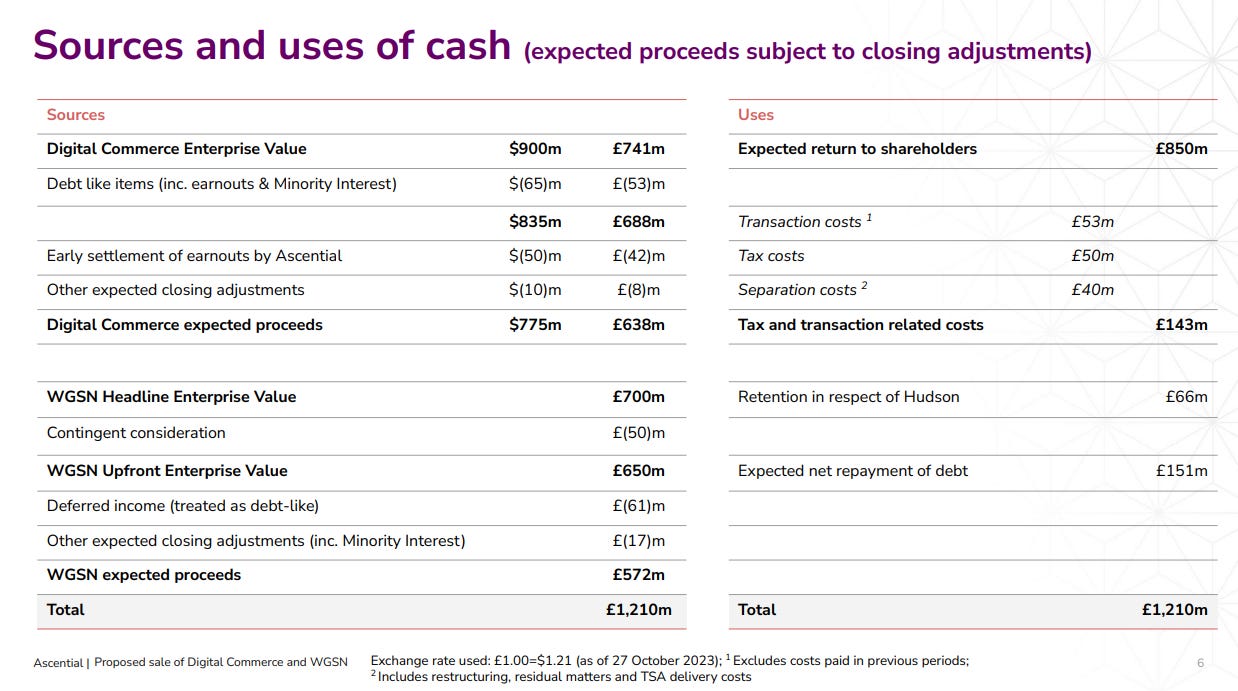

Now, the company announced a proposed sale of businesses 1 and 2. The product design business is to be sold to Apax Partners for an EV of GBP 700m and the digital commerce business is to be sold to Omnicom for US $900m. Combined, the proceeds of the transaction total GBP 1,210m.

A total of GBP 360m will be retained to pay for: taxes and transaction expenses (GBP 143m), net debt paydown (GBP 151m), and to satisfy the Hudson Mx put/call transaction (GBP 66m).

This leaves behind GBP 850m that will be paid out to shareholders via a special dividend. On a per-share basis, this is worth 191p (vs. the current price of 262p).

So here is where things get interesting. ASCL will be left with its event business, which is composed of two big events: Cannes Lions and Money 20/20; Cannes is the largest advertising/creative show worldwide and Money 20/20 is the largest fintech event in Europe.

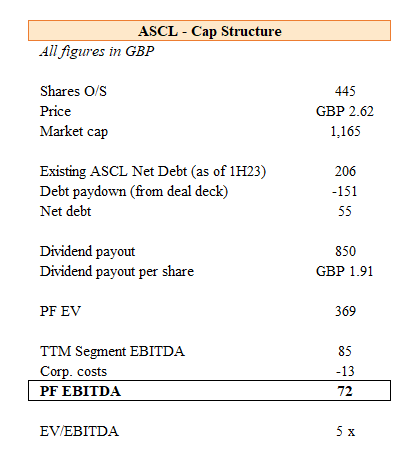

In the last 12 months, the events business generated GBP >200m in revenue and 85m in EBITDA before corporate expenses. Management expects about half of the current corporate overhead (run-rating at GBP 26m per year) to stay with the remainco. Therefore, the events biz should be earning $72m in TTM EBITDA.

Pro-forma for the dividend payout of GBP 850m and the debt paydown (there was GBP 206m in net debt in 1H23; 150m of this will be paid down), you can purchase the remainco for an EV of ~GBP 370m. This puts the events business at a ~5x EBITDA multiple. That is quite attractive.

What do we think it’s worth? Events businesses typically trade at a HSD to LDD EBITDA multiple (EEX is at 9x NTM EBITDA, for instance). A good comp would be Hyve Group, another events business in the UK, which was sold to a PE buyer for 11x EBITDA earlier this year. At 10x, for instance, the stock (combined with the dividend of GBP 191p per share) could be worth about 340p.

Ultimately, the most likely outcome for the events business is a sale. A strategic, for instance, would be able to get 2 high-quality events and would be able to cut down corporate costs by another GBP ~10m or so, lowering the effective multiple. In early October, there was a news story claiming that a consortium has been looking at the events business, although during the M&A call, the chairman noted “no ongoing conversations.”

Another interesting angle, however, is the company’s ownership in Hudson MX. Hudson MX is a US-based SaaS startup that helps media companies organize ad buys. This asset has been deemed “non-strategic” and a sales process has been initiated, with Omnicom stating its intention to participate. Notably, Ascential’s current CEO is leaving the company and heading to work at Omnicom. Presumably, he knows the asset well and likes it enough to take it with him to his new job.

The situation here is a bit messy given some restructuring. To simplify, ASCL owns 36.5% of the equity in Hudson and will be exercising a put/call agreement to bring up their stake to 79%. Now, ASCL is setting aside GBP 66m to satisfy the put/call transaction (paying for a ~43% stake) from the sales proceeds of the 2 businesses. This move is quite conservative, as in a sale, Hudson MX is still likely to be worth something! The implied EV in the put/call transaction is GBP ~150m (66m / 43%). If you assume they can sell the asset at this same price, the incremental value to ASCL shareholders should be ~$120m GBP (GBP 150m x 79%); the put/call has been paid for already. On a per-share basis, this is another incremental ~30p. It’s really hard to figure out what Hudson is worth given a lack of visibility and its early-stage nature (2022 revenue was GBP $2.3m, as per the annual report). So if you handicap this and say they sell this at a 50% discount to the last “price”, you still get another ~15p of upside.

Putting it all together, we have 1) the GBP 191p dividend per share, 2) the value of the events business of ~GBP 150p, and 3) possible upside from the Hudson MX sale of ~GBP 15p (or more). This gets us to roughly GBP 360p or about >35% upside relative to the current price but >100% upside once you net out the dividend.

The downside is very well protected given the incoming cash from the sale of businesses and Hudson Mx. Moreover, in a tougher environment, if EBITDA declines to, say GBP 50m per year, at a 5x multiple, that’s still worth about 45p per share. In this scenario, the stock would still be worth ~250p, or about 5% downside.

At the current price, I think the risk/reward is very compelling. LONG.

Risks: there are a few, mainly: 1) the deal still requires shareholder approval, 2) there isn’t a lot of near-term visibility in the events business, and if we are entering a downturn, companies could cut back on their spending.

Timing: the transactions will be voted on at the company’s general meeting in December. ASCL expects the transactions to be completed by Q1 2024.

Here’s the spreadsheet / back of the envelope in case it’s helpful.

A few resources that might be helpful

Thanks so much for reading! Let me know if you have any thoughts, questions, or pushback in the comments below.

Excellent writeup, as usual. I took a position. Some notes I had:

1) The company is guiding net debt after the transaction to 100M vs the 55M you estimated. From the M&A call: "As you've just seen from Slide 6 of the deck, we're having net debt repayment of about GBP 150 million. And therefore, we would expect the pro forma to be of order. And bear in mind, we're going quite some time into the future into Q1 of next year. But we do expect the pro forma to be around GBP 100 million of net debt."

2) While the company guided to 13M of corporate costs sticking with events, they clarified on the call that that doesn't include share-based comp which would be about 5M annually: "So the answer is the GBP 13 million does not include share-based compensation. Given that the Events business will be substantially smaller than Ascential and just in terms of number of heads, yes, the vast majority of that share-based payments charge will go with the disposal of businesses, both WGSN and Digital Commerce. And what we would expect is of order GBP 5 million-ish, something like that as our annualized share-based payments charge going forwards. So if you want to have a total, including share-based payments, you would take the GBP 13 million and then you would add GBP 5 million."

3) I've been worried about the Hudson MX value given this isn't the best market for unprofitable ad-tech startups, but I became more optimistic after some quotes on the call: "So in relation to the Digital Commerce sale, Omnicom were very clear that their offer was for the Digital Commerce business. But through the process of that exercise, it also clearly raised their significant interest in Hudson. But they recognized that should there be a process for that transaction or that business, which clearly, we were in the position to sell Digital Commerce. We were not in a position to sell Hudson. The right to sell Hudson is the majority owner of the company, which isn't us. But actually, through the end of this exercise, I think it would be fair for you to conclude that for a very financially savvy owner, for them to conclude to enter into a sales process would tend to suggest that there is a fair degree of interest."

Appreciate another great idea from CSC! I noted the capital distribution is expected to be a "special dividend" rather than a "return of capital" which may open us up to a large taxable event. Maybe I missed something. Thoughts?