Three-minute pitch #8

Growth at a reasonable price (GARP) with a kicker

If you look in the niches of the European markets, you’re bound to find some treasure.

This name fits a familiar pattern: growth at a very reasonable multiple with a nice kicker in the form of accelerating revenues and a shift into a new business model that should drive margins materially higher.

Let’s take a look.

Vente-Unique (FR: ALVU) is a French e-commerce retailer specializing in the sale of furniture and homewares at affordable prices. The company has a market cap of €130m (9.7m shares O/S) and ~€30m in net cash for an EV of ~€100m.

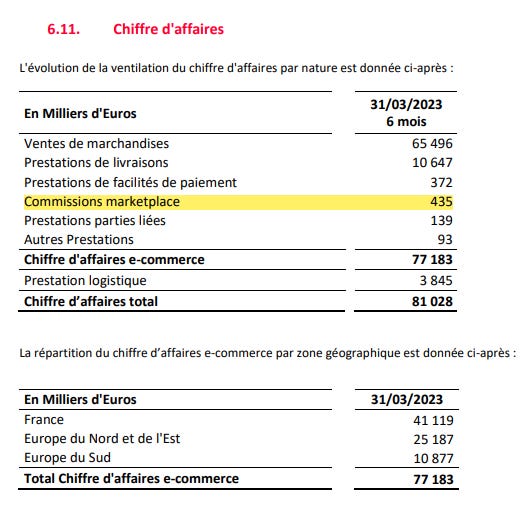

The company operates in 11 countries, with 52% of sales originating in France, 33% in Northern and Eastern Europe (Germany, the Netherlands, Poland, and others), and the remainder in Southern Europe (Italy, Portugal, and Spain).

The company was founded in 2006 and IPOed in 2017 as a spin-off from its corporate parent, CAFOM, which still retains 63% of the company. Management owns another ~10%, which leaves a relatively small float of ~2.5m shares.

While most furniture e-commerce businesses have been characterized as experiments in cash incineration, Vente-Unique has been consistently profitable for the last 17 years - and not on adjusted numbers. From fiscal 2015 to 2023, Vente-Unique grew sales at a 12% CAGR, and EBITDA margins averaged 7-8%. The company is capital-light, operating one warehouse and outsourcing product deliveries to 3PLs.

Vente-Unique reported solid FY23 results this morning, with the core e-commerce business generating €11.5m in EBITDA and €9.6m in operating profit. [Note: these numbers are for Vente-Unique and not the group, which consolidates a logistics platform that inflates EBITDA numbers.] On FY23 EBITDA, ALVU is trading at less than 9x EBITDA.

This value represents about half the multiple of most e-commerce furniture players. Wayfair, for instance, trades at 22x NTM EBITDA, Home24 at 19x EBITDA, and Temple & Webster, which barely has any EBITDA, trades at ~2x NTM EV/sales (if you assume a ~10% steady state EBITDA margin, that’s about 20x). On the one hand, the discount can be explained because the stock is small, illiquid, underfollowed (covered by one analyst), and controlled by a parent (CAFOM). It doesn’t help that the company’s annual reports are in French only - although the company does provide some trading updates in English.

What is more interesting, however, are two things:

The company has returned to top-line growth over the last few quarters and is exiting FY23 with its e-commerce business growing +17% and GMV +28%.

The company has rolled out a marketplace model (i.e., 3P = third party), which will drive margins materially higher over the next few years.

First, the company has seen sales normalize in the last few quarters after the post-COVID slowdown. The company’s model of more “affordable” offerings is resonating with consumers in a weaker European environment. Moreover, given the low online penetration of furniture/homewares sales, I expect that the company can still grow sales by at least a double-digit (i.e., +10% or more) rate for the foreseeable future.

Second, in late 2022, the company began to roll out its marketplace offering, starting in France and continuing to other countries during the second half of 2023. While this should be beneficial to consumers who can access a much wider selection (SKU count has gone from 10k to >100k), the biggest benefit is to the company’s underlying earnings power. Marketplace sales - i.e., a commission on a sale - require little to no incremental capital or expense, which means that the flow through to EBITDA should be almost 100%.

In the first half of FY23, ALVU reported >€400k in commissions as the marketplace began ramping up in France. While the annual report is not out yet, I estimate that ALVU generated >€1m in marketplace revenue (about ~€15m in GMV). While this seems small, I think the marketplace will likely grow very quickly over the next couple of years (marketplace GMV is growing at about 30% QoQ, by my estimate). The company reported, for instance, that marketplace GMV in France represented about 15% of the total in September 2023. Assuming that total marketplace GMV can reach ~20% of the total by FY25, marketplace revenue/EBITDA could reach about €4m.

If you look at historical numbers, the company has generated a ~7% EBITDA margin on its own first-party sales. If you assume that they can grow sales at 12% over the next two years with flat 1p margins and then layer on the marketplace revenue (at 100% EBITDA margins), total EBITDA should grow to ~€18m in FY25 (at a ~9% margin). That’s a substantial number on a ~€100m EV.

Importantly, marketplace GMV could accelerate further as the company rolled out marketplaces in Germany, Belgium, and Switzerland at the end of Q4 and will expand to the Netherlands and Portugal this coming year.

Given the acceleration in revenue and the higher returns from the shift into a marketplace model, I would expect a substantial re-rating in the shares. While I don’t expect ALVU shares to trade to the level of peers, I think shares could easily re-rate to a low-double-digit (LDD) or mid-teens multiple. At 12x EBITDA, the shares could be worth €25, or about 90% upside to the current price.

Capital allocation is also quite good for the size of the company. The company pays out dividends (~2% dividend) and repurchases shares occasionally.

Given the possibility of an inflection in earnings and the low starting valuation, I think Vente-Unique is quite compelling here. LONG (disclosure: I own shares).

Model

Catalysts

Ramping of new marketplaces (Germany, Belgium, Switzerland) and launch of new ones in FY24 (Netherlands, Portugal)

Earnings releases showing a lift in margins / more data on the marketplace.

A potential return of capital (special dividend?) as cash piles up on the B/S.

Risks

Furniture demand / macro situation weakens.

I could be wrong in my analysis/estimates of the marketplace benefit.

This is small and illiquid, so there’s a risk the market won’t care or won’t give it an adequate multiple.

Thanks so much for reading! Let me know if you have any thoughts, questions, or pushback in the comments below.

Have you looked at their German peer Westwing? Similarly cheap, returning to growth, repurchasing shares, and with a slightly higher end focus.

Interesting idea! Looks like they're historically not very capital efficient (low ROA, ROE, ROIC) paired with an inventory buildup. Nonetheless their projected EBITDA growth and NTM EV/EBITDA are compelling. Certainly on the watchlist for me.