Trade Idea #3

An event-driven short (story)

EDIT: Closed this out on 10/3/24 for a 5% loss.

This idea is an event-driven short. It’s a departure from what I typically write about, but I thought I’d give it a try.

I rarely short stocks but see a solid risk/reward in a large-cap, highly liquid stock. The catalyst occurs tomorrow and should play out over the next few weeks.

Given that this is a short, I would caution you to size this appropriately given the inherent risks involved.

Let’s get on to it.

The idea is to short Palantir (US: PLTR) [disclosure: I’m short the equity] to play the S&P 500 index addition.

PLTR will be added to the index tomorrow, Friday, September 20th, so tomorrow is the best time to short it.

The thesis is pretty simple:

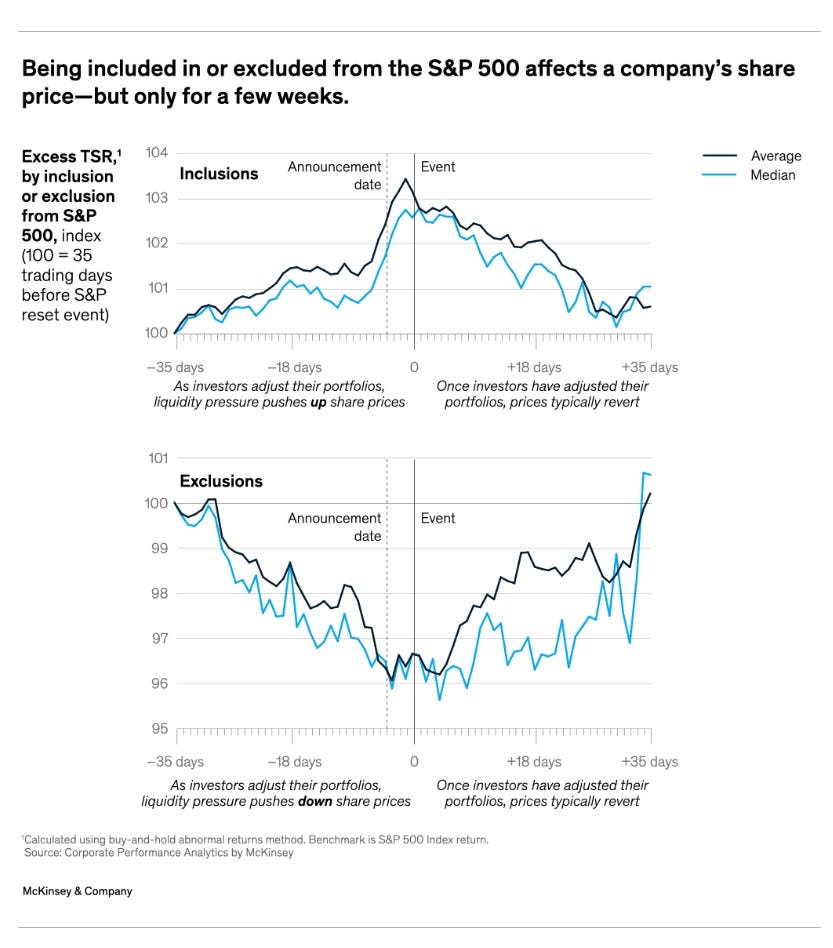

Index additions tend to result in “buy the rumor, sell the news” type events, where funds/arbs chase the stock up to the inclusion, trying to front-run the passive flows. Index additions then underperform significantly over the next month.

PLTR sentiment is at an EXTREME. PLTR has become one of the most popular stocks in the market, and there have been many warning signs of extreme sentiment (CEO tendies video, CEO going on Bill Maher, PLTR unveiling a merch store, etc).

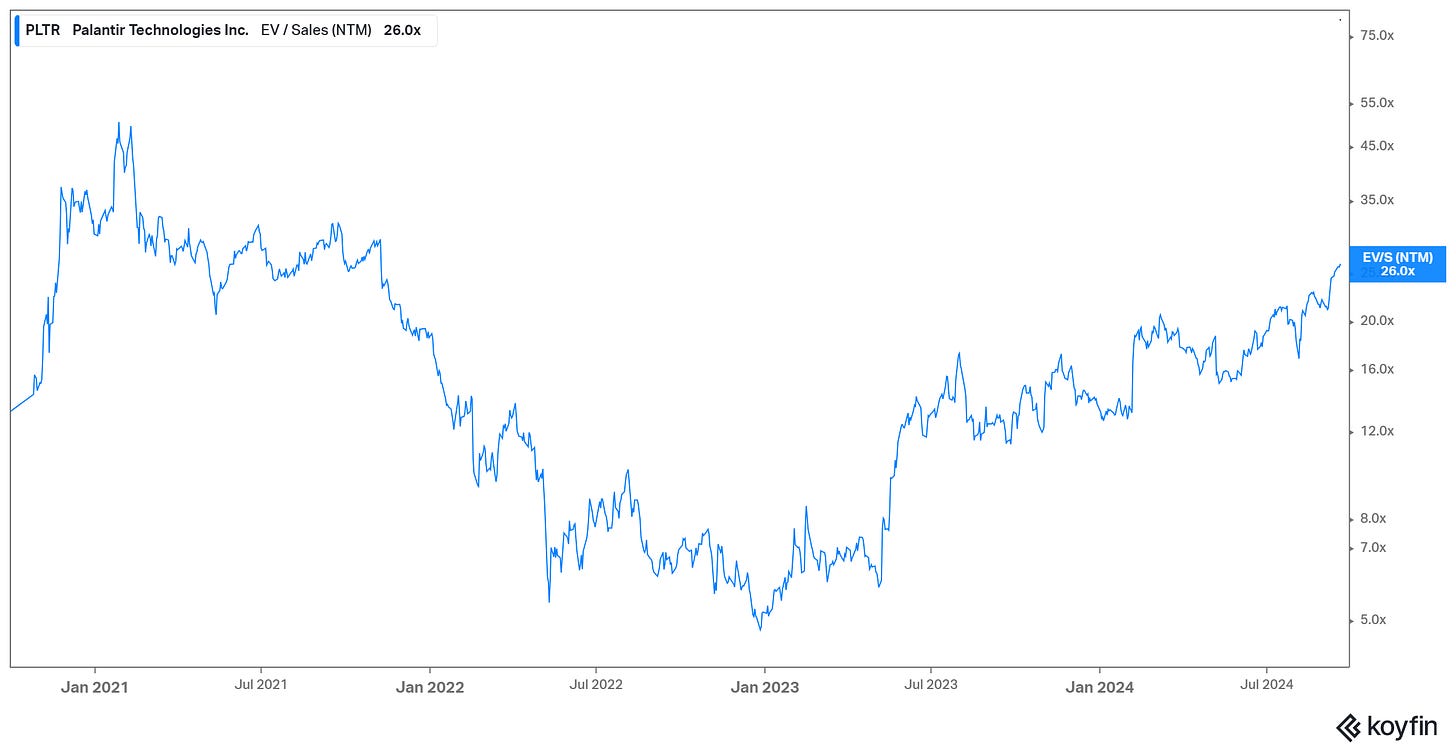

PLTR is trading at an unsustainable valuation of 26x NTM sales — the same valuation it traded at during the 2021 craziness. The sell-side expects mid-20s top-line growth and 20% growth next year. The stock is up 114% YTD, while cloud companies (i.e., the Bessemer Index) are down 9%.

I want to be clear that this is not a fundamental short. I don’t think there’s anything wrong with the business. But I do think the index addition dynamic creates a good asymmetric shorting point.

For reference, high fliers added to an index recently have had some meaningful drawdowns. For instance:

SMCI was added to the S&P 500 on March 18th. From March 15 (the previous Friday) to March 19th, the stock declined by 25%.

DECK was added to the S&P 500 on the same data as SMCI. The stock traded up ~5% and then traded down 14% by April 10th.

To be fair, they don’t always go down. GDDY was added recently, and the stock stayed flat; so did KKR. Crowdstrike declined due to other idiosyncratic issues.

You might think I’m cherry-picking here, but index inclusions tend to have some poor historical returns. Here’s a study from McKinsey from 2024. In brief, it shows that stocks trade up 3-4% in anticipation of an inclusion and then give back the same gains the month after.

Palantir is up 20% since it was announced that it would be added to the S&P on September 6th — quite the move already. By that same logic, I would expect it to trade back down to the $30 range at the least. In AH trading, PLTR is at $36 a share, which would mean a ~20% downside target.

To manage risk, I suggest setting a stop 5% higher than the current price of $36. Call it $38. I think this sets up an attractive risk/reward skew, with a potential gain of $6 to a potential loss of $2.

While I’m playing by shorting the common stock, I’m sure there are better ways to play it with options. Let us know in the chat if you have any ideas.

Anyways, that’s the short pitch. Let me know what you think.

I do these trades a lot. I’d say be prepared to hold through the next week or 2. I’ve seen them top the day of the addition but also a week or 2 later. Vanguard doesn’t buy all their weighting in one day, they also buy it before and after the add date so sometimes it chops higher a bit. Next week is the weakest week seasonally of the year so could also get a market dip to help out

So short be the open. Any thoughts on timing of the short . I’ll take a look at options in the AM