Updates: November 21, 2023

Quick thoughts on Zenvia (US: ZENV) + closed positions + open positions

Hello Ultimate Value readers!

I am back with some quick updates. Next weekend, I will also be publishing a new actionable idea, so keep your eyes open for it.

Now, let’s take a look.

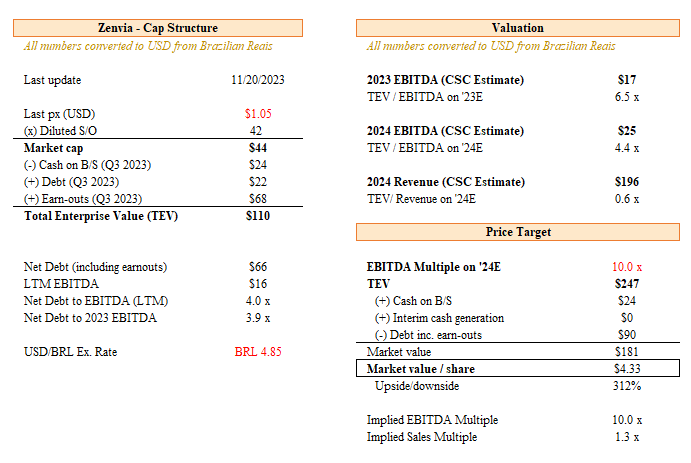

Zenvia - Risk/reward still favorable

I first wrote up Zenvia in early September when Zenvia was trading at $1.03 per share (disclosure: LONG, and added). Post-earnings, ZENV is back to roughly the same level after trading as high as $1.40 a couple of weeks back.

Please refer to the original write-up here for the full pitch.

The core of the Zenvia thesis is that the company’s funding gap will be soon fixed. Once this issue is resolved, I see the opportunity for a substantial re-rating given the gap between Zenvia’s valuation (~4x ‘24 EBITDA) and other publicly listed SaaS companies in Brazil, which tend to trade at low double-digit EBITDA multiples.

If you are familiar with the story, you know that Zenvia took on significant debt structured as earnouts when it made several acquisitions after its IPO. The original plan involved doing a follow-on offering to raise the funds needed to pay for the acquisitions. Unfortunately, the window for raising equity closed too soon. Consequently, Zenvia has had to find creative ways of dealing with the earnouts. So far, the company has done an admirable job of meeting the challenge by pivoting towards profitability, as well as through tapping working capital (from Twilio, an important partner and 10% equity owner), and by working with the sellers to term out some of the payments.

Zenvia reported earnings last week. Frankly, there wasn’t a lot that was incremental to the story. On the negative side, earnings were a bit lighter than expected, and the SaaS business underperformed due to continued macro weakness; on the plus, the CPaaS business performed better than expected, management noted an improving SaaS pipeline for Q4, and there was some positive commentary about the improving funding environment in Brazil. The improved environment is key, as the best outcome would be for the company to take on bank debt to push out upcoming earn-out payments and avoid having to raise equity in a dilutive scenario.

Bottom line: given the steady progress Zenvia has made thus far, I believe that it should be close to announcing a permanent fix to its balance sheet issues. If the downside scenarios get taken off the table, I think that the fair value for the stock could easily be in the $4+ range without heroic assumptions, which makes this a very compelling risk/reward.