Cheapest e-com biz in the world?

Tiny e-com biz trading at <6x FY25 EBITDA with accelerating fundamentals

Hello Ultimate Value readers!

Over the past few weeks, I’ve been seeing a lot of bargains, particularly in the <$100m space. Being a full-time private investor, I am able to invest in anything: micro-caps, large-caps, whatever. All things equal, I’d rather have better liquidity. However, some of these opportunities are too good to pass up!

The company we are looking at is one such example. I’ve followed this company for a while and think the time is now right to own this. This is a free cash flow positive, adjusted EBITDA break-even e-commerce business in a good category. While the post-COVID environment has been tough, the company is now seeing revenue re-accelerate. I believe that the company can get back to at least a mid-teens top-line growth rate from here with substantial margin expansion ahead.

At 0.25x EV/sales, 0.7x EV/GP, and <6x FY25 EBITDA, I believe the opportunity is compelling. Let’s take a look.

Investment Thesis Summary

The company we are looking at today is Adore Beauty (ASX: ABY)

Adore Beauty is the number one pure-play online beauty and personal care (BPC) retailer in Australia. It IPOed in late 2020 at $6.75 per share and is now trading under $1.00.

After a post-COVID slowdown, ABY growth metrics have troughed and have begun to re-accelerate. I expect ABY to revert back to mid-teens plus growth over the next 12+ months.

ABY has a credible path to significant margin expansion within the next 2-3 years. I expect they can get to at least ~7-8% EBITDA margins.

On my 2025 estimates: ABY is trading at 0.25x EV/sales, 0.75 EV/Gross Profit, and <6x EBITDA. At a 9% steady-state EBITDA margin, the company is trading at ~3x EBITDA on my estimate of 2025 sales.

All-in, I think shares could easily double from here and potentially 2-3x if the company is able to execute.

Why this might be mispriced:

Broken IPO: Adore Beauty IPOed in late 2020 in an overheated stock market that prioritized growth above all else. ABY started trading at $6.75 per share and is down to less than $1, a +85% drop from the IPO.

Small-cap and illiquid: The company’s market cap is ~$90m AUD, which is too small for most funds. Liquidity is limited, with an average daily traded volume (ADTV) of <$100k USD per day.

COVID bullwhip effect: Adore Beauty benefited massively from COVID lockdowns, as consumers resorted to buying beauty products almost exclusively online. Post-COVID, there has been a long period of demand normalization and user churn.

Capital structure

Please note that the company reports in Australian Dollars.

The company’s capital structure is very simple and clean. Adore Beauty has a market cap of $90m AUD, roughly $30m in net cash on the balance sheet, and an enterprise value of ~$60m.

Business background

Adore Beauty is the number one pure-play online beauty and personal care (BPC) retailer in Australia. The company was founded in 2000 out of a garage by Kate Morris and was bootstrapped until Quadrant Private Equity acquired a majority stake in 2019. Adore Beauty then IPOed in late 2020 at $6.75. In FY23, the company generated ~$180m in sales and breakeven adjusted EBITDA; the company was, however, FCF positive.

Adore Beauty offers over 12,000 products from more than 270 brands. ~57% of sales come from skin care products, ~27% from haircare, ~14% from makeup, and 2% from fragrance. While the vast majority of sales consist of 3rd party brands, ABY has more recently launched 3 of its own with ~30 SKUs. ABY aims for its brands to account for >10% of sales by FY27, which have +80% gross margins.

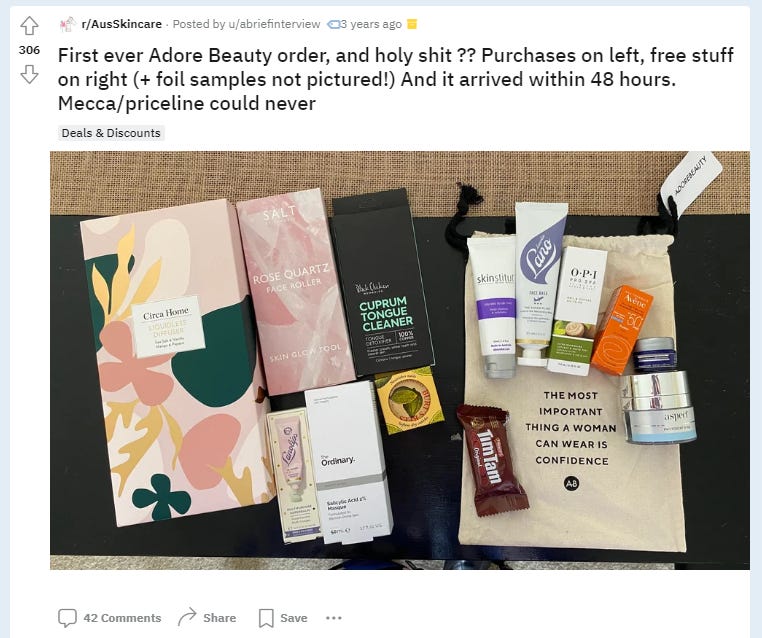

Adore Beauty has differentiated itself in a few key ways. First, it aims to go above and beyond in its customer service. This is partly done by providing best-in-class delivery times: sales placed before 4 p.m. are sent out the same day and the company provides free express shipping (1-3 business days) on orders above $65. Customers also receive free promotional samples and candy.

While customer service and fast shipping times can be matched by competitors, Adore Beauty has also become a content platform. The company launched BeautyIQ in 2016, which puts out articles, videos, and podcasts. BeautyIQ’s content is focused on product education and awareness. The real benefit here is that ABY can generate organic user traffic and thereby reduce its total cost of user acquisition over time.

The BPC category is a competitive space. Adore Beauty operates as the leading online specialist. Offline, it mainly faces BPC specialists such as Mecca and Sephora. Moreover, BPC products are also sold in department stores such as David Jones and Myer, as well as in pharmacies such as Priceline and Chemist Warehouse.

ABY is well-positioned online. Online sales of beauty and personal care remain woefully underpenetrated in Australia relative to other Western countries. In 2022, for instance, Australian online BPC sales were only ~12% of the total, relative to the US at 36% and the UK at 43%. There is no real structural reason why Australia should not eventually close that gap over time.

Thesis:

After a deceleration in revenue growth, ABY growth metrics have troughed and are set to re-accelerate over the coming year. I expect ABY to revert back to mid-teens plus growth over the next year.

Adore Beauty’s sales have grown rapidly. In FY18, the company was generating ~$50m in revenue. By FY22, the company was at $200m in sales. While COVID accelerated online adoption, the hangover post-COVID has been surprisingly mild so far, despite investor concerns. Sales in 23Q2 and 23Q3 were down LSD. 1Q23 was weak (-29%), but this was comping the prior year’s lockdown when sales grew +25%. In total, FY23 sales decreased 10% vs. FY22, but it’s important to put it into context: sales have grown at a CAGR of 25% to FY23 from FY19.

However, sales declines are already past us. Revenue began to reaccelerate in Q4 and into Q1 as reported in the last trading update. Q4 revenue grew +4% and the trading update specified growth of +6% during the last 6 weeks. I believe the company should start to see revenue continue to accelerate from here as e-commerce trends continue to normalize.

On a longer timeframe, I believe that Adore Beauty should be at least a mid-teens grower as BPC sales continue to transition online. Prior to COVID, online sales of beauty and personal care gained ~1pt of share per year. If you assume this continues at the same rate and the BPC category grows ~4%, the online market should easily grow at a low-teens rate. If you assume that ABY takes a slight amount of incremental share, ABY should thus grow top-line at a mid-teens rate. Furthermore, ABY continues to expand into adjacent categories (Korean cosmetics, fragrance, etc) and has other initiatives that should drive some incremental growth as well.

ABY has a credible path to >8% EBITDA margins within the next 2-3 years.

Adore Beauty has averaged 3% adjusted EBITDA margins (SBC and addbacks are minimal) from FY18 to FY22. This was done while the company invested heavily to grow. While the company over-earned in the last two years due to a COVID-19 benefit, the company still has meaningful room to expand margins.

In the past, management has guided to a long-term margin target of 8-10%. I believe that this guidance is actually credible, despite skepticism from most investors. This is how they are likely to bridge the gap:

Normalized profitability: ABY has operated a +3-4% EBITDA margin in the past, even prior to COVID-19. While margins in FY23 decreased to ~0%, I believe most of the short-term headwinds should start to reverse in FY24. The majority of the margin impact was due to operating deleverage as sales decreased by 10% (180bps hit to EBITDA), followed by increased marketing costs (70bps) due to Apple privacy changes impacting the cost of user acquisition on Facebook. Lastly, gross margins were affected by inflation and a more promotional environment (50bps). As the company returns to growth in FY24 and some of these pressures ease, I expect ABY to recover at least 250bps of margin. This is consistent with management’s outlook for 2-4% EBITDA margins.

Branded products: ABY aims to take up sales of its own branded products to at least 10% of total sales. These products have gross margins in the ~80% range. This margin should be at least 30% higher than that of 3rd party products. [Note: the company discloses gross margins of ~33%, however, this includes the cost of delivery. Product gross margins are likely in the 40-50% range.] Given the margin differential, there should be an incremental +3% benefit to EBITDA.

Marketing: ABY will be able to at the very least, keep marketing flat as a percentage of sales, as 1) returning customers continue to make up a greater share of sales, 2) organic traffic initiatives (BeautyIQ, leveraging its own App, loyalty program) continue to bear fruit, and 3) marketing efficiency normalizes post-Apple privacy changes. Marketing expenses as a % of sales were below 10% pre-COVID and reached 15% in FY23.

Operating leverage: with the exception of marketing, the remainder of the company’s costs are mostly fixed in nature. Thus, costs will continue to grow but at a slower pace than revenue growth. I expect that ABY can get an incremental 1-2% pts of EBITDA margin from operating leverage alone over the next couple of years.

Putting it all together - you get a 3% “normalized” margin + 3% increase from branded sales and a 1-2% point increase from operating leverage. This should get us to a roughly 8% EBITDA margin, which I believe should be achievable by FY27 and squares with management’s target of 8-10%.

While there are only 3 sell-side analysts that cover the stock, no one is really giving the company much credit for the potential margin expansion that could occur over the next 2-3 years. As seen below, analysts are anchoring around the 2-4% EBITDA margin guide. This means there should be a meaningful upside to numbers if ABY continues to execute.

The business itself is not as bad as investors make it out to be.

The beauty and personal care category is structurally more attractive than other e-commerce concepts. I believe that BPC is better because:

Demand for BPC is relatively inelastic - traditionally, beauty and personal care products tend to do well in most consumer environments - even during recessions. Despite high prices, skincare/cosmetics are often seen as “affordable” luxuries (see the lipstick effect, for instance).

Low returns - Unlike apparel, for instance, where consumers usually order multiple items due to fit issues, cosmetics are rarely sent back.

High value to weight - BPC products are typically small and light and can be affordably packaged and shipped.

Little inventory risk - BPC products are shelf-stable (usually they can last about 30 months) and there is no “fashion” or obsolescence risk.

High margins - BPC products have structurally higher gross margins even at wholesale.

Repeat category - due to its replenishment nature, consumers tend to order products more frequently. ABY returning customers, for instance, order 3x per year on average. This is a big positive because it creates much better longer-term customer lifetime values.

Ultimately, these favorable characteristics should translate into better economics and profitability.

While on the surface, ABY seems like a commoditized seller of BPC products, it’s more defensible than meets the eye.

Brand exclusivity - BPC brands are very particular about the retailers they work with, and it often takes a long time to develop these relationships. ABY itself has some brands which exclusively sell on the platform.

Content platform - ABY content platform has been built out organically over the last 7 years. In FY23, content put out drove over 215m (+23% YoY) impressions across IG, FB, YouTube, TikTok, and 9 owned podcasts.

Brand/reputation - Adore Beauty’s brand has been built for over 20 years. Given the nature of BPC products (i.e. you put it on your skin, etc), consumers will not want to buy a product from a company they haven’t heard of.

The business is capital-light and should produce meaningful cash flow.

The business barely requires any incremental capital to grow. There are costs to running the e-commerce website and for fulfillment, but the company leases its distribution center. CAPEX costs per year are minimal at $2m per year. Proof is that the business was pretty much bootstrapped since its founding.

Edit: October 15. 1:13 pm EST. I initially missed this in the write-up, but a reader kindly pointed out this news story from last week where ABY retained UBS to fend off “opportunistic acquirers.”

Valuation & Price Target

The company’s valuation is incredibly attractive, with a solid risk/reward.

On my 2025 estimates: ABY is trading at 0.25x EV/sales, 0.75 EV/Gross Profit, and <6x EBITDA. At a 9% steady-state EBITDA margin, the company is trading at ~3x EBITDA on my estimate of 2025 sales.

My price target is AUD $2.00+ per share. I value Adore Beauty on an EBITDA multiple and back into the implied sales multiples. I use a 15x EBITDA multiple on my 2025 estimate. This imputes an enterprise value of ~$160m or a 0.7x sales multiple. At a steady-state margin, which I believe should be >9%, this implies an EBITDA multiple of ~7x.

If I roll forward my 15x EBITDA multiple on FY26 and FY27 estimates, I think the stock could be worth $3-$4 per share in 2-3 years.

Model and estimates

This model has a bit more levers than usual: new customers, retention, average orders per user, and average order value. The key part of the model is the percentage of branded product sales, which drives the uplift in gross margin. It’s likely worth taking a look at the model (attached) if you want to get a better sense of how they can get to these EBITDA targets.

Risks

Given the low valuation, there is a risk of a possible take-under by Quadrant Private Equity (QPE) or by the Founders, Kate Morris and James Height.

Competitive environment - there is a risk that the competitive environment worsens and that Adore Beauty has to become more promotional.

As always, if you have feedback or suggestions on what I should look into, send me a note to info@clarksquarecapital.com or @clarksquarecap on Twitter.

Thanks for reading!

Great write up man. Who are their biggest competitors in Australia?