L'Occitane International S.A. (HK: 973)

Leading global beauty and personal care (BPC) player at ~10x FY25 earnings growing at a mid-teens plus rate over the next few years.

Hello Ultimate Value readers!

I am back with a new idea today.

Given the spirit of the holidays - Happy Thanksgiving! - I am making this one available to everyone as a way to say thanks. I feel truly blessed to be able to do exactly what I love to do every single day. So thank you for all of your support!

If you find my work valuable, you can help me out by sharing my publication with friends and colleagues or by simply giving me a like. And be sure to sign up below if you haven’t! Thank you!

Investment Thesis Summary

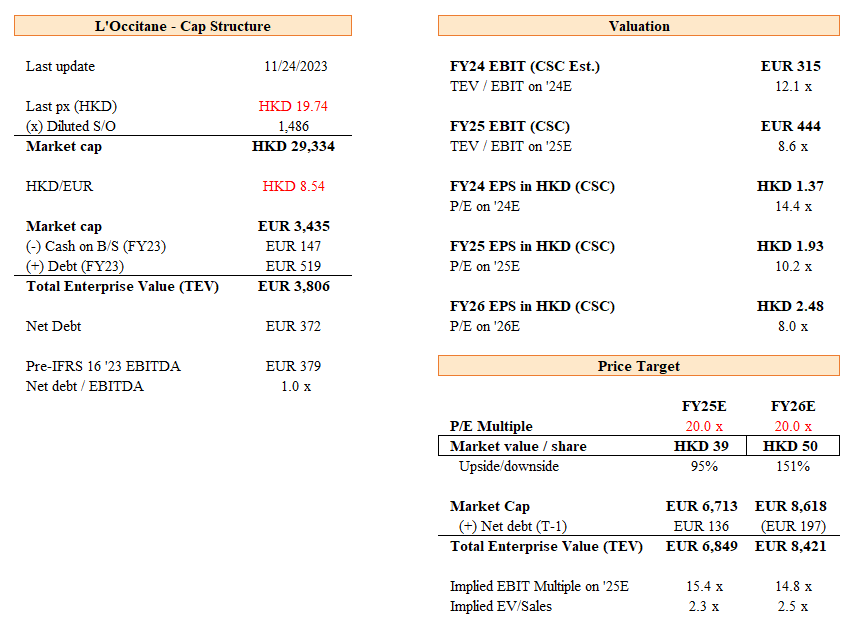

The company we are looking at today is L’Occitane (HK: 973) [disclosure: I own shares]. L’Occitane has an EV of EUR $3.8B and trades ~$2m USD per day.

I believe the stock is compelling for the following reasons:

The near-term stock setup has been derisked due to the lowered margin guide for FY24 and the consequent failed take-private attempt.

L’Occitane’s top line will continue to grow at least double digits due to Sol de Janeiro, which is growing triple digits and shows no signs of slowing down.

A recovery in Elemis + L’Occitane provides further upside to top-line growth. I model a mid-teens rate over the next two years.

I expect L’Occitane’s EBIT margin to revert above 15% by FY25.

The low absolute and relative valuation makes the risk/reward compelling. The downside is likely capped by a takeover or a re-listing.

I see a pathway for the shares to be worth at least HKD 40 in a year or roughly double today’s price.

Why this might be mispriced

Orphaned equity: Despite being a predominantly French company, the stock trades in Hong Kong. This mismatch creates a conflict, as European investors might not be able to buy the stock due to fund restrictions even if they are interested in the company.

Failed take-private: in August, a news story suggested that the Chairman was interested in acquiring the remaining shares of the company he does not own (he owns c. 70%). However, the Chairman ultimately decided to walk away from the deal, causing the share price to collapse.

IR / corporate disclosures are poor: Transcripts of the company’s calls are not on Bloomberg or other news services despite regularly mentioning critical details, including forward-looking guidance.

Trading dynamics

The average daily traded volume is roughly $2.0m USD per day, which makes this liquid enough for PAs and small funds.

Capital structure

Please note that the company reports in EUR, while the stock price is quoted in HKD.

The company’s capital structure is simple and clean. L’Occitane has a market cap of EUR 3.4B and an enterprise value of EUR 3.8B.

Net debt is manageable, at 1.0x net debt to EBITDA.

Business background

L’Occitane is a global manufacturer and retailer of beauty and personal care products focusing on natural and organic ingredients. The company has close to 2,800 retail outlets with 1,360 owned stores and a presence in more than 90 countries. The company was incorporated in Luxembourg, has headquarters in France, and trades on the Hong Kong exchange.

The company’s major brands include L’Occitane en Provence, Elemis, Sol de Janeiro, and others. Sales are split almost evenly across retail, online, and wholesale, each taking up roughly a third of the total. L’Occitane is well diversified geographically, with sales coming primarily from Asia Pacific (APAC) at 42%, followed by the Americas at 33% and EMEA at 25%. In FY23, the company generated €2.1B in sales and €337m in adjusted operating profit at a ~16% margin.

The company’s leading brands (and reporting segments) are:

L’Occitane en Provence - fragrance, skincare, haircare, and body and bath.

ELEMIS (acquired in 2019) - skincare.

Sol de Janeiro (acquired in 2021) - fragrance, skincare, haircare, and body care.

Other brands - include Erborian, L’Occitane au Bresil, Grown Alchemist, LimeLife, and Melvita.

Recent events

The last six months have been volatile for the stock price. Let’s recap what has happened since the company announced FY23 results.

June 26, 2023 - Management reports strong FY23 results but unveils an unexpected $100m incremental investment into marketing and growth investments, primarily directed at the core L’Occitane brand, which had performed well in FY23 (+7% YoY CC) ex. Russia (divested) and China.

August 8, 2023 - A Bloomberg story comes out, claiming that the company’s Chairman, Reinold Geiger, who owns ~70% of the company, is interested in taking the company private at HK$35 per share (a 37% premium to the last closing price.)

August 11, 2023 - L’Occitane confirms that the Chairman is interested in taking the company private but at a price of “no less than HK$26.”

September 4, 2023 - The Chairman reports that he has decided not to proceed with a deal to acquire the remaining shares of the company he does not own. The stock falls ~30% to HK$20.

Thesis

The near-term stock setup has been derisked due to the lowered margin guide for FY24 and the consequent failed take-private attempt.

The recent selling has been driven by two big non-fundamental events.

First, the company lowered its margin guide on account of the Board’s decision to spend an incremental EUR 100m on marketing for FY24 (which brings down EBIT margins 400bps to ~12%, as per the guide). This decision was made despite the fact that core brands have performed quite well; even core L’Occitane grew nicely in FY23 if you exclude Russia and China. I believe that this expense is more likely to prove a one-off in nature rather than an increase in the cost of doing business.

Second, the Chairman decided to not take the company private after news stories claimed he was interested in doing so, initially at a price as high as HKD 35 per share. This caused the stock to trade back down to the HKD 20 range. Deal break events such as this one can be a good hunting ground for opportunities due to the technical selling pressure that occurs.

Combined, these events have created an attractive entry point in the stock, as the company continues to execute well, but the price has come down, and the shares have de-rated significantly in the interim.

L’Occitane’s top line will continue to grow at least double digits due to Sol de Janeiro, which is growing triple digits and shows no signs of slowing down.

Sol de Janeiro (SdJ) has been a fantastic acquisition for L’Occitane. Over the past few quarters, the brand’s growth has accelerated to triple-digits on an annualized revenue base of over EUR 600m, with the latest reported quarter (Q2) being particularly strong. If SdJ can maintain a similar rate of growth on an absolute “dollar” basis, the brand’s growth will lead to a double-digit growth rate for L’Occitane.

It’s hard to forecast the growth of SdJ accurately. But, there are a few things here that give me confidence that SdJ can continue to, at the very least, keep growing at the same rate on an absolute “dollar” basis.

First, SdJ is expanding to new markets this year, such as Hong Kong. Second, SdJ has no presence in travel retail, an important sales channel for most BPC brands. This year, they have launched travel retail in Europe and North America. More importantly, SdJ will launch travel retail in APAC markets in the back half of FY23; these are some of the biggest markets for BPC in the world. Third, SdJ continues to launch successful new products. When SdJ was acquired, their Bum Bum Cream represented over 50% of sales. Less than two years in, however, SdJ’s fragrance mists are now the number one selling product. Lastly, SdJ’s exclusivity contract with Sephora in the US ends in FY24, allowing the brand to enter other retailers.

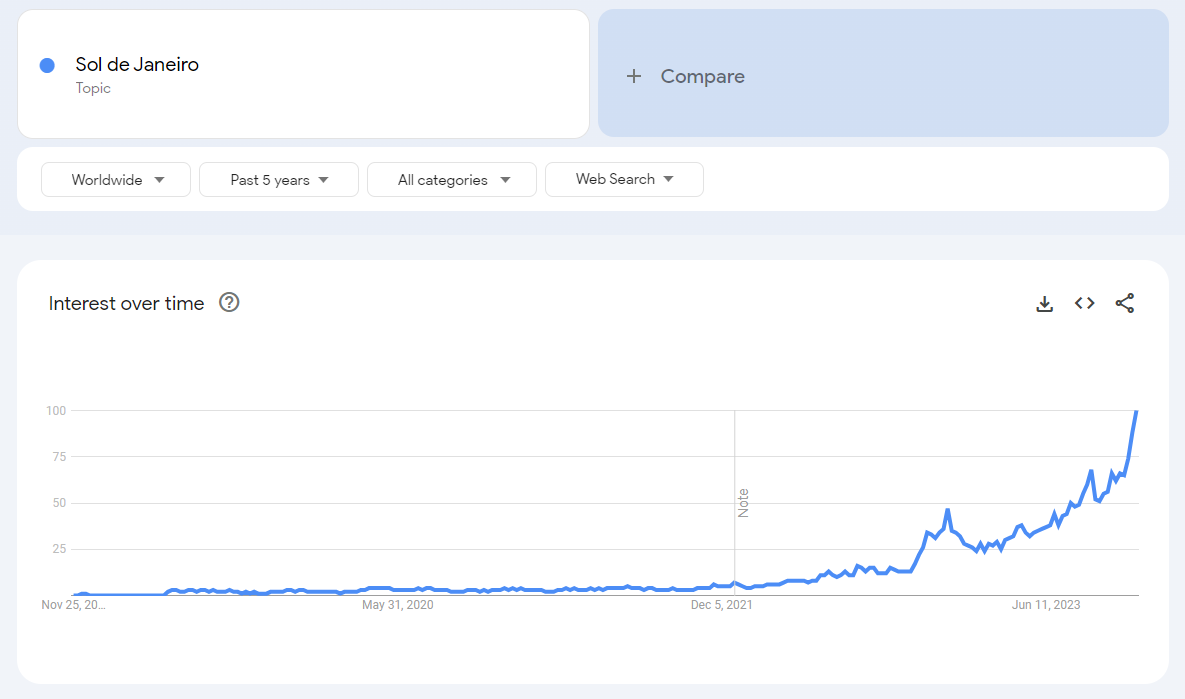

A Google Trends search also confirms that global search interest for Sol de Janeiro remains exceptionally high. Given the above, I see no reason why SdJ can’t be a +EUR 1B brand within the next two years.

A recovery in Elemis and core L’Occitane provides for further upside to top-line growth.

Both Elemis and L’Occitane en Provence had a couple of issues in FY23, which should prove to be temporary.

In the last few quarters, the brand Elemis has been making a move towards “premiumization”. In order to carry this out, they have reduced their placement of products into e-commerce channels that had been overly promotional. This has weighed on growth in the last couple of quarters (FY24 H1: +7.6% cc), but management expects normalized growth to trend toward a mid-teens constant currency rate in the medium term.

For L’Occitane en Provence, the core band has had more hiccups. First, the brand divested its Russian operations in June 2022, which had an impact on the reported top-line numbers. This impact, however, will be lapped from Q3 (this coming quarter) onwards. Similar to other BPC companies, the core L’Occitane brand has slowed due to weakness in the Chinese market as well as in the APAC travel retail channel. The good news is that in the latest quarter (Q2 24), L’Occitane en Provence FY24Q2 saw an improvement and grew “double digits” in China. Management expects the core L’Occitane brand to grow at a mid-single-digit growth in the medium term.

L’Occitane as a whole is woefully underpenetrated in travel retail relative to peers. Once the channel recovers, there could be a meaningful upside. Moreover, the company is investing EUR 100m into marketing, with the bulk of this going to L’Occitane en Provence. This investment could also serve as a catalyst to re-accelerate sales in the company’s core brand beyond MSD.

I expect L’Occitane’s EBIT margin to quickly revert back above 15% in FY25.

Despite the significant investment of EUR 100m slated for FY24, I expect that the faster-growing brands Sol de Janeiro and Elemis will be able to help offset the drag due to their higher margins.

Sol de Janeiro carries an operating margin of ~25% relative to L’Occitane en Provence, which sits at a mid-teens margin. Likewise, Elemis operates with an operating margin closer to 20%. These two brands will drive the majority of growth over the next few years, and the overall margin will benefit from this positive mix shift for years to come.

Despite the talk of incremental investment, the company reiterated that its mid-term guide of ~16% operating margins was intact. To me, the whole guide seems like a good way to reset expectations (particularly if you’re going to make a bid for the company). This means that there is a good chance that we will see continued margin expansion from these levels.

The low absolute and relative valuation makes the risk/reward compelling. Importantly, the downside is likely capped by potential corporate action.

L’Occitane’s valuation is outrageously cheap. The stock is trading at ~14x FY24 earnings on what will be trough margins (~15x consensus numbers). On my FY25 estimates, the stock is likely trading closer to 10x earnings. Historically, 973.HK has traded at an average multiple of ~20x earnings, with an all-time low multiple of ~12x earnings.

Skincare/beauty peers (L’Oreal, Estée Lauder, Shiseido, etc.) tend to trade at >30x earnings and ~20x EBITDA with sell-side estimates that call for mid to high-single-digit top-line growth. In M&A transactions, you see similar multiples. Aesop, for instance, was recently sold to L’Oreal for ~20x EBITDA.

The downside is well protected, given the low valuation and the fact that the company is likely to pursue some corporate action to unlock the value if the value discrepancy remains. The Chairman might try to acquire the company again, or the company might try a re-listing on another exchange. This was an alternative that was being explored at the same time the Chairman had been looking to take the company private. The “bid” from the Chairman was HKD 26 per share. On FY24 earnings, that would have implied a multiple of 20x (EUR 2.5B at a 12% EBIT margin, assuming 25% tax).

Valuation & Price Target

The company’s valuation is incredibly attractive.

$973.HK is trading at a very inexpensive valuation on my estimates:

On FY24 estimates, $973.HK is trading at 14x EPS (trough margin)

On FY25 estimates, $973.HK is trading at 10x EPS.

My price target is HKD 40 per share. I keep the valuation simple and value the company on a P/E multiple. I use a 20x P/E multiple on my FY25. This implies an EV of ~EUR 6.8B or a 15x EBIT multiple.

If I roll forward my 20x PE multiple on FY26 estimates, I think the stock could be worth roughly HKD 50 per share in ~2 years.

Model and Estimates

Here is a copy of my earnings model. It is also attached below.

I am also attaching my model in case it’s helpful.

Risks

There is a big risk of a take-under from the Chairman since he owns ~70% of the company.

It’s possible that we don’t see a re-rating, given that the stock trades in Hong Kong. Although, it’s hard to ignore growing earnings over time.

China/travel retail weakness could continue, although L’Occitane is less exposed than most BPC companies.

Catalysts

FY24 earnings showing a much better FY25 EBIT guide + continued trading updates showing top-line growth, particularly for SdJ.

Possible buyout offer from the current Chairman.

Possible re-listing the stock to another exchange.

The mid-term (FY26) guide will have to be upgraded, as the company had set this in FY22 when Sol de Janeiro had just been acquired. Initially, they expected the brand to CAGR at ~30%, but SdJ has grown dramatically faster than management’s initial expectations.

As always, if you have feedback or suggestions on what I should look into, send me a note to info@clarksquarecapital.com or @clarksquarecap on Twitter.

If you have enjoyed the post, please subscribe below and be sure to share it with a friend or colleague. Thanks for reading!

Any comment on how they ended up with a HK listing? Obviously they sell a lot into Asia, but why would that affect listing choice? Maybe currying favor with China government?

CS Capital:

I have owned a small position for a while.

Comments on today's H1 earnings? I was surprised by the stock reaction given that mgmt had warned about the increased mktg spend previously. But perhaps the magnitude of the mktg spend and the lackluster non-SdJ rev growth are the reasons.

SdJ results continue to look great. They are going to blow away your 584mm forecast this FY. And margins are as expected for SdJ. I do not think it is crazy to think that SdJ alone is worth more than the current TEV.

Of course, the problem is the other two segments. How do you view the enormous marketing spend in L'Occitane? Is this really an investment, or are they just throwing good money trying to keep a weak and drifting brand alive? A lot of the story here depends on one's trust in management doing the wise thing (by shareholders) with respect to L'Occitane.

Based on the mgmt comments regarding current quarter sales, the marketing spend does not appear to be working any wonders. Perhaps it is too soon to see results?

Elemis results in H1 also disappointed. It is in a tough space with tough competition.

The good news is that at this price, the stock has pessimism for both Elemis and L'Occitane.