Quick Pitch #24

A US-listed co. trading below liquidation value with optionality

Hello Ultimate Value readers,

I am back with a new idea.

In this crazy market, I’ve been focused on finding opportunities that offer significant downside protection while still providing some upside optionality.

I believe I found a good one.

Let’s take a look.

Company: Vera Bradley

Ticker: VRA

Stock price: USD $2.25

FD Shares O/S: 28 million

Market cap: $63 million

Net cash: $7 million

EV: $57 millionVera Bradley (US: VRA — disclosure, I own shares) offers attractive downside protection and plenty of upside. On the downside, it is well protected through its significant asset value (real estate, inventory), part of which is about to be unlocked. On top of that, an activist in the stock, Fund 1 Investments, which owns 10% of the company, has been agitating for a sale of the company. Best of all, the company is in the middle of a turnaround that is already providing positive proof points. A return to profitability would result in a much higher stock price.

What does the company do?

Vera Bradley is a leading designer of women’s handbags, luggage, backpacks, and other accessories. The company was founded in 1982 by Barbara Bradley and Patricia R. Miller. The Brand is known for its iconic patterns and brilliant colors.

Today, the company sells its products through retail, ecommerce, and wholesale. The company operates 39 full-line stores, 87 outlet stores, and its e-commerce sites. The wholesale side consists of sales to 1,200 specialty retail locations (almost all in the US), as well as sales to department stores, national accounts, and third-party e-commerce sites.

Ok, now let’s get into the setup and why this is interesting.

Let’s start with the downside case.

The company has substantial asset value. At the current price of $2.25, VRA has a market cap of USD $63 million and $7 million in net cash ($15m in cash, $10m in debt, and ~$2m in contingent consideration from the sale of Pura Vida).

On the balance sheet, the company has ~$20 million in A/R and ~$100 million in inventory. Offsetting liabilities are about $40 million. There’s another $50 million in net PPE. This means the tangible book is about $80 million, or about $2.90 per share.

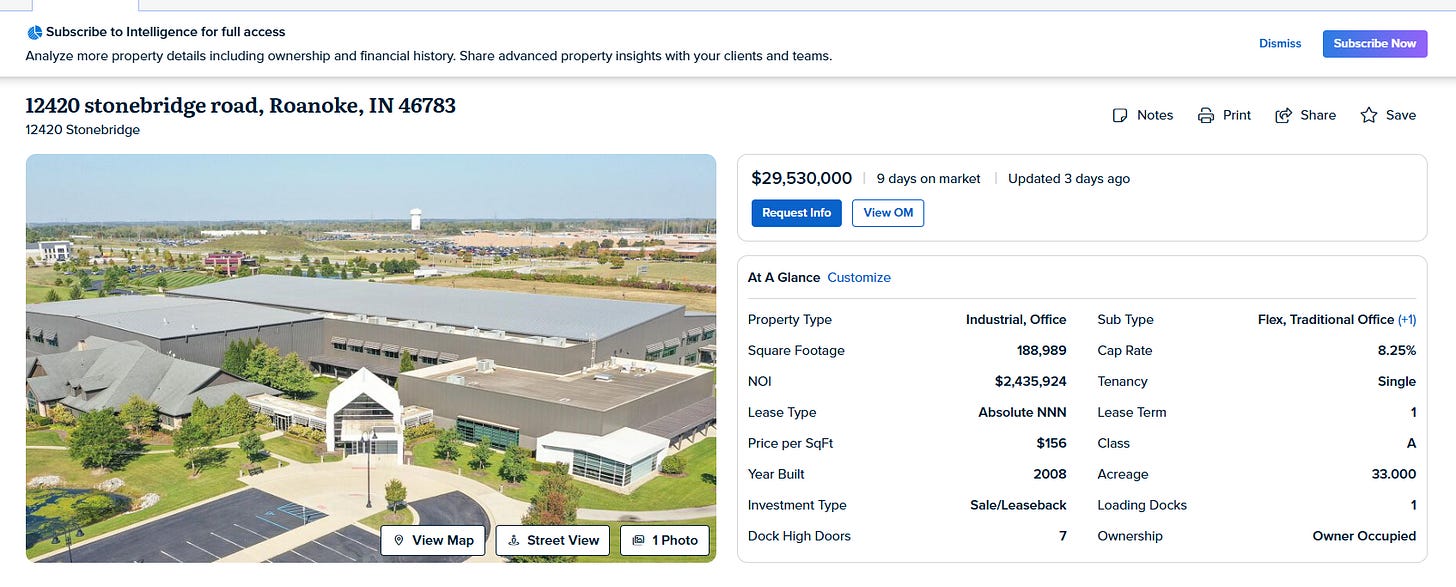

But the PPE does not tell the whole story. The company owns two buildings. First, the company owns a 188,000 sq. ft. building that serves as its corporate headquarters, design center, and showroom. Secondly, VRA owns a distribution center totaling about 430,000 sq. ft. These properties are located in Roanoke, Indiana.

A few days ago, the company filed an amendment to its credit agreement with JPM that essentially allows it to sell property assets without requiring the proceeds to be used for debt repayment.

This was a sign that something interesting was happening!

And it was, the company listed its HQ for a sale-leaseback transaction. The listing is for USD $29.5 million at an 8.5% cap rate. Keep in mind, this is on a market cap of ~$63 million! Sure, this is a listing, so there might be some differences in the final sales price and timing, but this helps illustrate the value here.

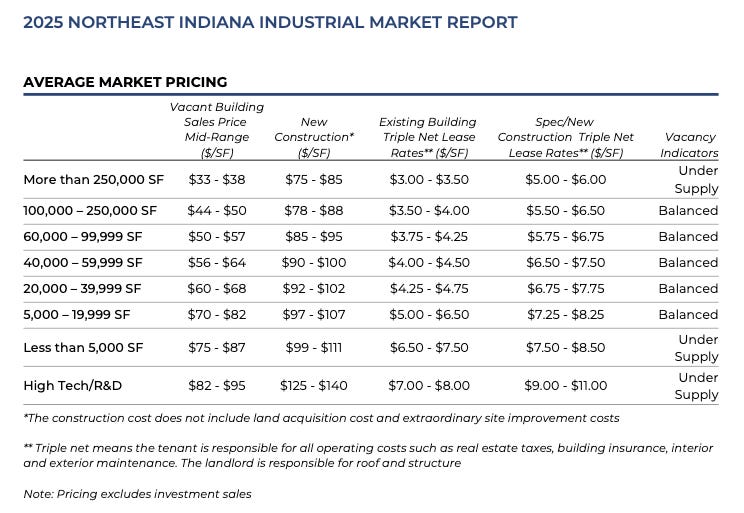

The second building they own is even bigger: their distribution center spans 430,000 square feet. It was built in 2006 and has been expanded over time.

A sale-leaseback of the distribution center could likely be worth another USD $20 million or so, based on $1.5 million of NOI (at ~$3.50 per sq ft) at a 7.5% cap rate1. These figures are just estimates and may ultimately vary. But there is value here.

On a combined basis, we are looking at circa USD $50 million of real estate value. I don’t expect the company to have to pay tax on these sales, since they recently sold their Pura Vida business at a steep loss and would likely have USD $80 million to $90 million in operating losses to shield these gains with.

On top of that, the company has about $100 million in valuable inventory. In a liquidation-type scenario, this could provide ~$70 million in cash. This means if you were to wind down operations, sell the inventory and the buildings, and pay off liabilities, you would be left with something close to $100 million — or about $3.602 per share vs. the current price of $2.25. This is solid downside protection.

Fortunately, some of the real estate's value will be unlocked sometime soon.

The other element that I think will provide protection is the involvement of Fund 1 Investments, which filed a 13D back in January of this year. Fund 1 owns 10% of the company, but has 20% economic exposure. They shared the letter they sent to management earlier this year. In it, they called for the company to explore a sale. Going private, they argue, would allow the company to focus on its brand revival without earnings pressure, identify cost savings, and free up management time.

While I am not counting on a sale of the company just yet, I believe having an aligned shareholder provides another layer of downside protection. If the company isn’t able to right the ship, it’s likely Fund 1 will continue to push for an outcome that can crystallize value for shareholders.

So how do we get paid?

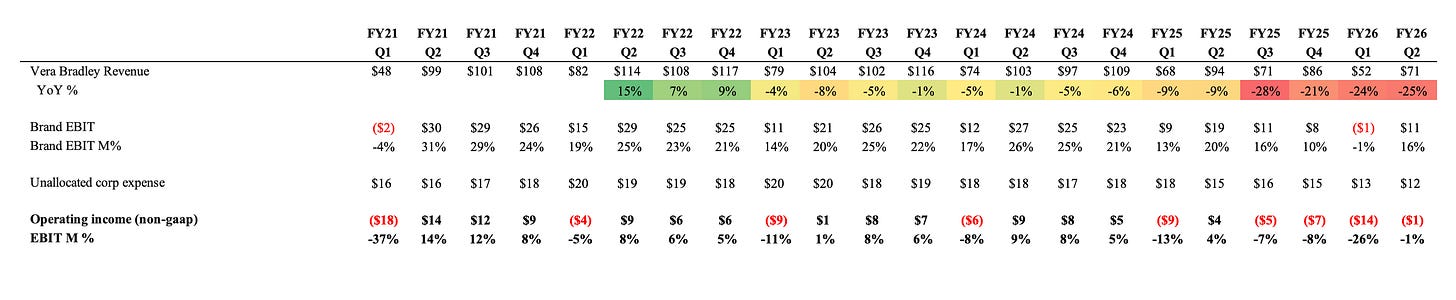

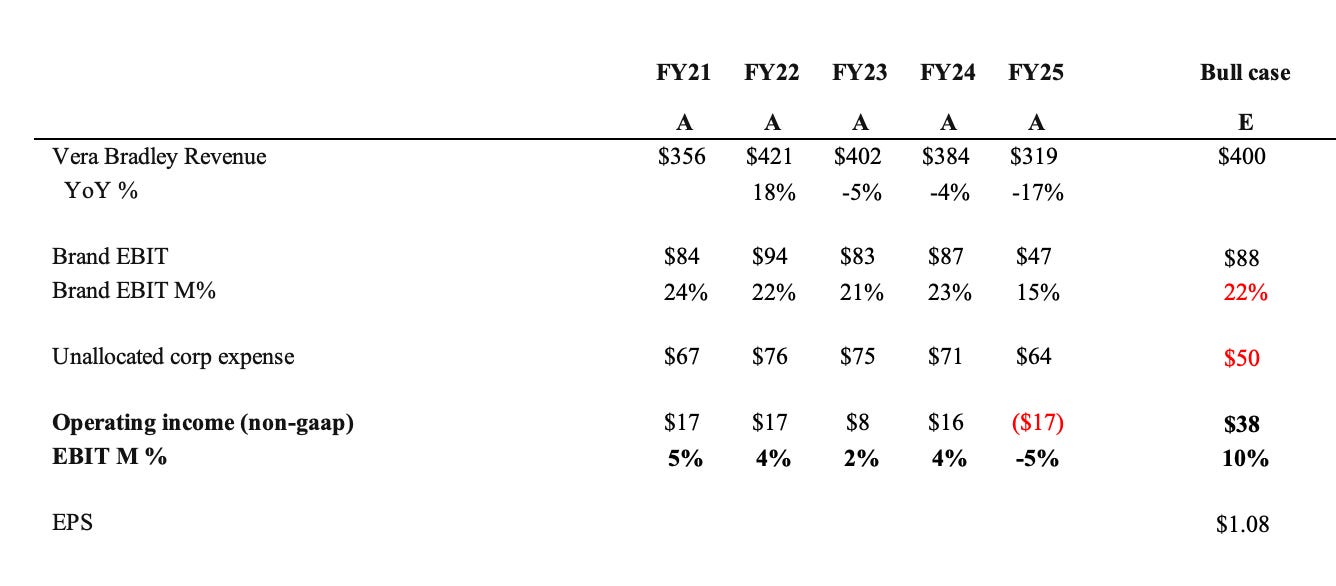

Historically, Vera Bradley — excluding the divested Pura Vida segment — has generated about $400 million in revenue per year, with an EBIT margin of low to mid-single digits. The company’s track record of past growth and earnings has been spotty, to say the least. However, the rails really started to come off last year. Under the old CEO, Jacqueline Ardrey, the company tried to reposition the brand and merchandise to compete with higher-tier handbag players such as Coach (i.e., leather products), rather than staying true to what makes Vera Bradley unique — cotton and vibrant colors.

To right the ship, Ardrey was let go, and a new CEO, a new CFO, and, more recently, a CMO were brought in. Management has been focused on getting back to its roots.

Now, I think VRA has the potential to really resonate with the consumer, given its heritage. Many brands that have leaned into the Y2K and nostalgia trends have enjoyed renewed success, including American Eagle, Ralph Lauren, and Gap. Vera Bradley was hugely popular in the early 2000s, so there is optionality here.

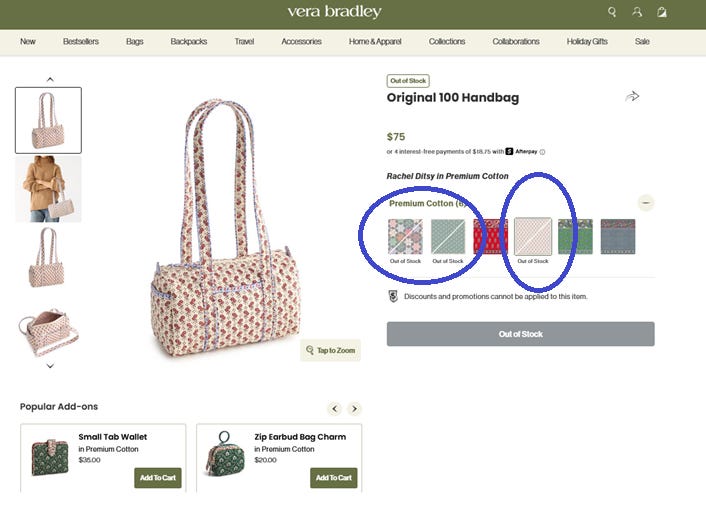

There are recent proof points that the company is making progress in righting the ship. VRA has been working on collaborations that sell out quickly, such as a recent capsule collection inspired by the Gilmore Girls. Moreover, VRA recently brought back its Original 100 handbag, which sold out of half of its styles in less than two weeks.

During the last earnings call, management highlighted positive signs: sales trends improved month over month in Q2, and comparable-store sales declines moderated as the company introduced new assortments.

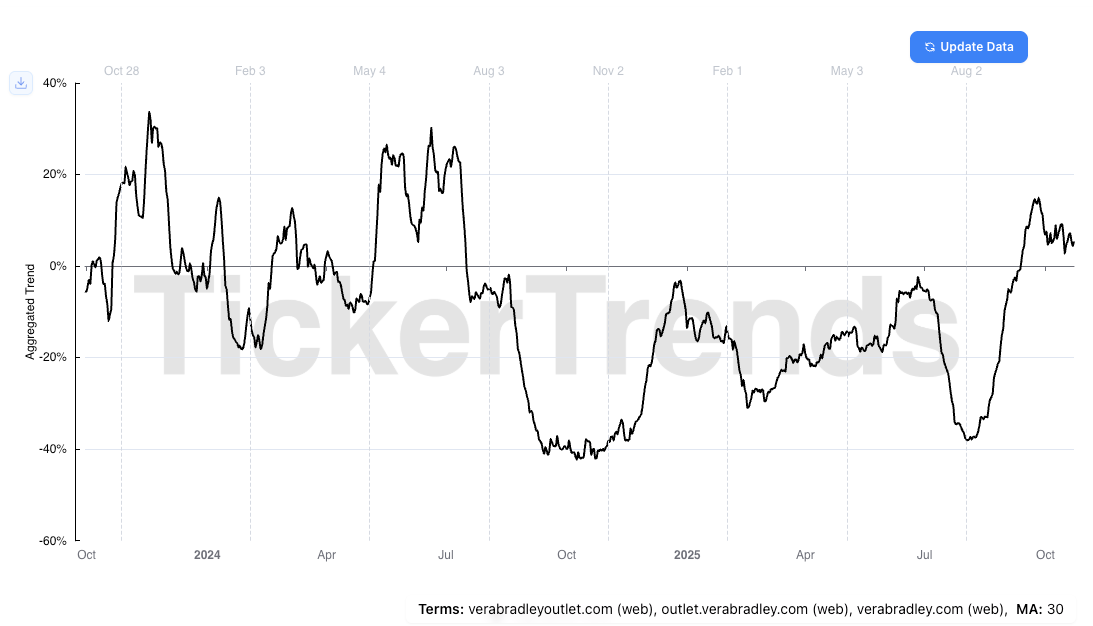

Importantly, web traffic is looking strong and has returned to growth in October —a notable trend, as it had not grown since 2024.

Comps also ease significantly this upcoming quarter, so if the company improves even slightly, it is likely to get back to top-line growth. The operating loss was also reduced to $1 million in this last quarter, a notable result given the top-line headwinds. A good Q4 (the largest during the year), and the company can likely get to profitability as well.

So what is this worth?

Retail concepts are always tough to model accurately. My assumptions are as follows. I think if VRA continues to make progress on its turnaround, it could return to circa FY24 profitability, which was ~$16 million in EBIT. This translates to roughly $0.45 in EPS. At a 10x multiple, this would be worth a double. VRA will also have about ~$30 million in cash, which is worth another $1.00 per share. Solid upside.

Now, the bull case is that they can return to FY22/FY23 sales levels — call it $400 million — on the current, reduced expense base. The company is running much leaner now, with corporate overhead reduced to $12 million per quarter. Hitting that sales level would translate into a ~10% EBIT margin and about $1.00 in EPS. Assume a 10x multiple, and there could be considerable upside here.

Putting it all together, we have a nice little net-net with solid optionality. The downside is well protected with asset value (real estate + inventory), and the upside could be significant if the company gains traction with its brand revitalization. LONG VRA.

In a true liquidation, you would have severance, and might have lease exit costs; on the other hand, we are assigning absolutely no value to the brand, which could be worth some money as well.

Interesting and underfollowed find, thank you!

I think the brand EBIT calculation makes a lot of sense from acquier perspective.

However, without indication of an imminent deal I am wondering about the cash burn - my FCF pre-NWC calculation is -15m for 1QFY26 and -5m for 2QFY26. Typically 2H is just a little stronger vs 1H (they seem to have always a strong 2Q, no idea why) so let's settle for -30m p.a. which means that they will run out of cash quickly and the real estate sale/leasback is not an upside, but a necessity to fund cash flow gap.

So it seems to me the case requires a fast return to cash breakeven, which is of course possible given the amount of op leverage in the business. Am I wrong in my thinking (I probably am :))?