Hello, Ultimate Value readers!

I have a couple of updates on a few positions I thought I’d share.

For more timely updates, be sure to check out the chat function.

On a personal note, I’ll be in Omaha next week for the Berkshire Annual Meeting.

Let me know if you’ll be there as well.

Closing this one out

L’occitane (973.HK)

In case you missed the news, L’Occitane’s Chairman announced a bid to take the company private for HKD 34/share. The stock has been halted pending news over the last three weeks. The press release states this is a final offer, meaning there will be no “deal bump” here, unfortunately.

As the market opened, I sold my shares at 33 HKD per share. If the deal gets blocked, we might see this trading back to the mid-20s, so I think the risk/reward of holding out for 34 is unfavorable.

The deal’s press release is here.

I originally wrote up the company in late November at a price of HKD 20 per share. While the takeout offer is slightly below what I hoped for, the ~70% return was still relatively attractive, considering the short holding period (5 months).

Important updates

Pinewood (PINE.LN)

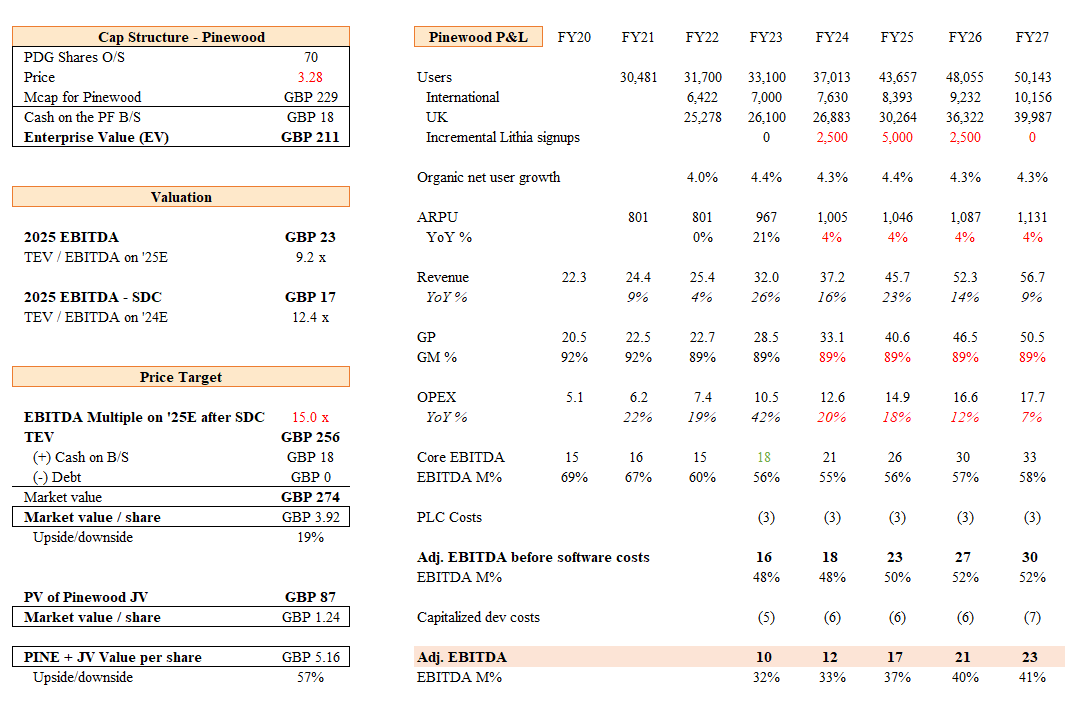

Last week, Pinewood began trading ex-dividend (24.5p payable on May 7th). The company also reported FY23 results on Wednesday, April 25th.

PINE is trading at 328p/share (41p adjusted for the 20:1 split and 24.5p dividend), a 28% return since I wrote up Pinewood (previously PDG.LN) back in November.

Check out the original write-up below.

FY23 results were in line with my expectations. PINE grew top-line +15.5% YoY and generated core business EBITDA of GBP 19.4m for FY23 (on a 12-month basis, this would be ~18m). Stand-alone (PLC) costs are run-rating at GBP 2.5m.

Optically, the stock might look somewhat unattractive for a few reasons:

FY23 results were messy due to the upcoming change in the company’s fiscal calendar. PINE is moving to a January-December fiscal year, so FY23 has 13 months, and FY24 will only have 11.

Broker estimates will likely be funky for FY24, given the 11-month period.

PINE will have ~2.5m of annual stand-alone (PLC) costs.

There is a timing difference, as PINE starts ramping up spending ahead of getting new Lithia customers, so EBITDA margins will look depressed in the interim.

Looking at FY23 numbers, for instance, the stock looks somewhat rich. With GBP 18m of core EBITDA, subtracting out PLC costs (2.5m) and capitalized development costs (5.5m) gets us to about 10m in “clean” EBITDA or about ~21x ‘23 EBITDA.

Nevertheless, the setup looks compelling here!

The Lithia tie-up will dramatically increase the opportunity for PINE, especially considering that, in the past, competing auto dealers were wary of using a competitor’s software. Let’s see what this looks like.

First, let’s assume a few things: 1) PINE continues to grow customers organically by 4% per year, 2) PINE keeps pushing pricing at ~inflation (4% per year), and 3) PINE signs on 10,000 users from the Lithia tie-up (the 2,500 UK, and 7,500 users afterward). [Obviously, they won’t sign all of the 10,000, but let’s not include any other deals that could pop up and call it a wash here.]

This gets me to ~GBP 17m in adj. EBITDA for 2025 (GBP 23m before capitalized development costs). Let’s say this is worth 15x, which gets us ~390p (20% upside). Not super exciting on its own.

But we haven’t put any value on the JV, which I think could be a significant driver of value. Lithia currently spends GBP 90m ($110m in USD) per year on its tech stack. Assuming that by 2027, the JV will be able to capture about half of that spend (growing 5% per year), the JV could be generating GBP 50m in revenue in FY27. This assumes no incremental deals outside of the Lithia spend. At a 40% EBITDA margin, that’s 20m in EBITDA (49% of which belongs to PINE). At a 15x multiple, that’s worth GBP 300m. The present value to PINE of that (at a 20% discount rate) is about GBP 1.25 per share.

At 390p for PINE and 125p for the JV, you are looking at a possible price target of 520p, or about 60% upside relative to the current price. There is still a lot of uncertainty here, but you can still buy the core PINE business for a “fair” multiple and get the JV for free. For those reasons, I remain LONG shares of PINE.

Thanks for reading! Let me know if you have any comments below.