Updates: November 6, 2023

Brief thoughts on CBD and ABY.AX

Hi Ultimate Value readers,

I am back with a few updates on CBD and Adore Beauty.

Let’s take a look.

Position Updates

Please see my updated thoughts below. I also highlight whether the setup has improved, not changed, or deteriorated within the last few months.

CBD - Risk/reward improved. LONG

CBD reported earnings last week that were very solid. Here are the highlights:

Revenue: +10% YoY (Pão de Açúcar +12%, proximity +22%)

Same-store-sales: +6.6% (Pão de Açúcar +7.2%, proximity +7.7%)

Adjusted EBITDA: R$333m, at a 7% margin (+120 bps YoY and +70bps QoQ)

Opened 20 stores during the quarter (18 proximity, 2 PdA)

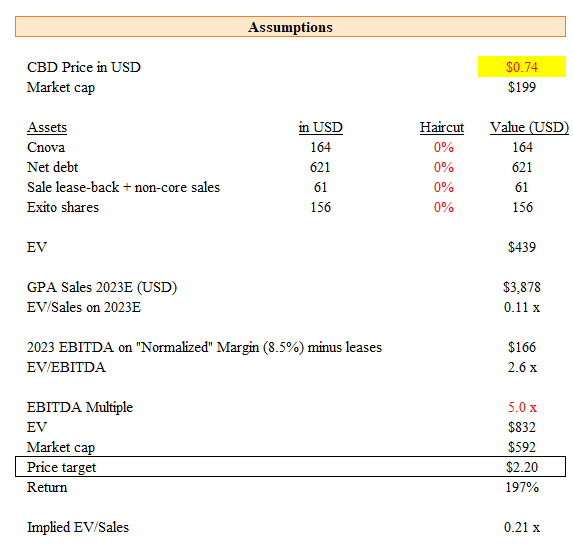

Overall the quarter showed good progress, particularly as CBD is now at a 7% EBITDA margin. If you were to annualize these results, CBD would be trading at an EBITDA multiple of ~4x (including lease expenses). If CBD can get closer to its 8-9% EBITDA target, then the company would be at less than 3x.

I think there’s a lot to like here. Post-spin, most investors kept their Exito shares and sold off CBD, which means the technical selling is likely done and expectations here are very low; how often do you see a company that is not in financial distress trade at 0.1x EV/sales? However, CBD keeps making progress in its turnaround and management keeps making smart moves to simplify and de-lever the company. Debt will continue to be paid down through the sale of CBD’s Exito stake (a done deal), its sale of Cnova shares (currently under negotiation), and other possible divestments.

Ultimately, I see the end goal for Casino Group - the one way they can wrap up their Latin America chapter with a clean exit - as a sale of CBD’s grocery store assets. In the interim, however, I expect shares to start trading closer to some semblance of fair value. In addition to steady operational progress, the shares are likely to benefit from some short-term catalysts, including: 1) an announcement regarding the sale of Cnova shares (analysts often value these at zero), 2) news on potential divestments, and 3) a planned analyst day in December. As for me, I really like the risk/reward from here. LONG.

Adore Beauty - Risk/reward still favorable. LONG

I wrote ABY.AX up on October 15, at a price of A$0.96 per share. Shares are currently trading at A$1.01. Adore Beauty issued a trading update last week. The results were solid, as expected.

As a quick recap, I wrote up ABY.AX and my thesis was:

ABY growth metrics have troughed and are set to re-accelerate to mid-teens plus growth over the next year.

ABY has a credible path to >8% EBITDA margins within the next 2-3 years.

ABY is trading at an attractive valuation.

Based on the results of the trading update, I can say that the thesis still remains on track. The quick takeaways from the trading update were:

Revenue of A$47.5m, +4.7% YoY

Customers: active customers +1.5% (back to growth), returning +4.7%

Reiterating 2-4% EBITDA margin in FY24

Valuation still remains compelling, at ~6x FY25 EBITDA and 0.3x FY25 sales. And that is on margins that I expect to be at roughly half of what they should be at a normalized level. My one-year price target is ~A$2.00 per share at a 15x FY25 EBITDA multiple, which imputes a ~0.7x EV/Sales multiple.

Just prior to publishing the original write-up, there was a news story out in the AFR claiming that ABY had retained the investment bank, UBS. The reason why was not exactly clear. Based on the company’s valuation and position in a good category (beauty and personal care = high value to weight / high margin / replenishable), it would not be a stretch to assume that they got approached by an interested strategic or PE buyer. While that’s not core to the thesis, I do think that could be an interesting angle that could help crystallize value quickly.

With an on-track thesis, low valuation, and possible takeout interest, I think ABY shares remain compelling here. LONG.

Alright, those are my quick updates on CBD and ABY.AX. Hope these are helpful.

If you have found my content value-additive, please consider becoming a paid subscriber. Thanks all!

Would there be any taxes related to monetization of XETO and the French asset .

So they don't have a tax of .3 right?