Updates: November 8, 2023

Quick thoughts on Outbrain $OB

Hello Ultimate Value readers!

I am back with a quick update on Outbrain.

Let’s take a look.

If you are not familiar with the story, take a look at my previous posts:

Original writeup:

I also wrote an update here:

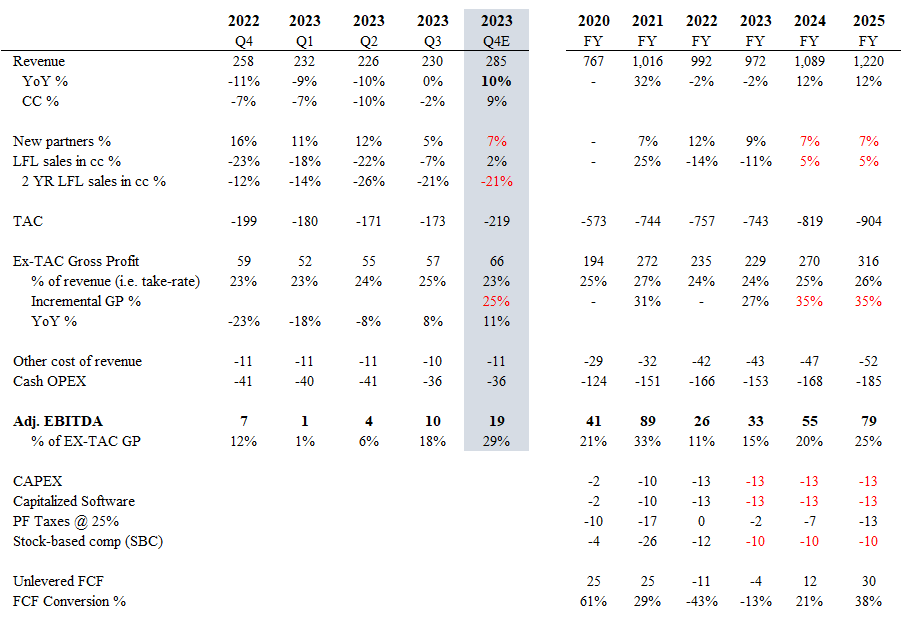

Outbrain reported quarterly results yesterday which were mixed. Q3 results were OK, but the Q4 guide was lowered and management struck a cautious tone given some macro and geopolitical-related headwinds.

While the lowered guidance was disappointing, I plan to give the position more time as I think some of the headwinds will prove to be temporary. Overall, I think the setup remains compelling, as OB is likely to benefit from a recovery in digital advertising and has a very attractive valuation.

Here are the quick highlights:

Q3 Results:

Ex-TAC gross profit of $57m (+8% YoY) vs. guide at $58m (+10% YoY)

Adj. EBITDA of $10m vs. guide at $8.5m

Q4 Guide:

Ex-TAC gross profit of $62m at MP (+5% YoY) vs. the previous guide which implied $72m at MP (+22% YoY)

Adj. EBITDA of $15m vs. the previous guide which implied >$17m (guide at >$30m for FY23)

So let’s take a look at some of the positives and negatives from the report:

Positives:

Nice beat on adjusted EBITDA for Q3 although this was mostly driven by cost-cutting; OPEX was down ~10% sequentially given the previously announced reduction in force (RIF).

Guide for Q4 EBITDA ($15m) still implies an annualized run-rate EBITDA of ~$55m, which puts OB at <2x EBITDA.

Negatives:

Lowered guidance for both Ex-TAC GP and adj. EBITDA

More cautious tone regarding the demand environment - although, it’s not clear whether it’s a macro issue or due to the Middle East conflict (brands do not want to advertise next to war stories).

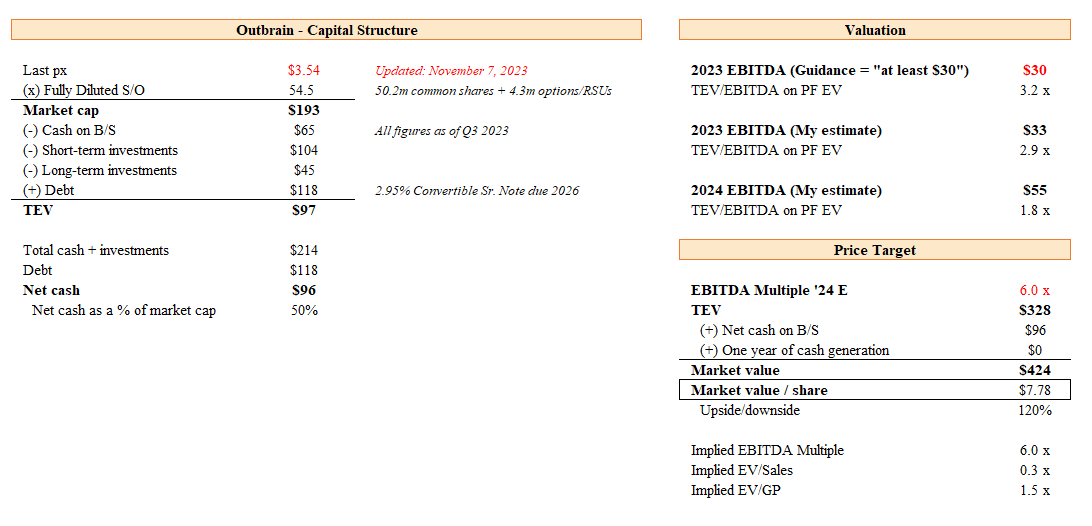

While the results were somewhat disappointing, I think it’s important to put them into context. Since I originally shared the idea back in May, the stock has essentially round-tripped (I wrote it up at $3.79, it went up to $6, and is now back down to $3.60). At this level, I think there should be solid valuation support, as OB has about 50% of the market cap in net cash. On this year’s guidance of $30m in EBITDA, the stock is trading below 3x; at the current EBITDA run-rate, it’s less than 2x. Barring some disastrous results, it’s hard to see how you lose much money here.

While the lowered guide reflected a more cautious tone, management set the guide assuming absolutely no improvement in the demand environment.

During periods of geopolitical conflict, as happened with Ukraine, we’ve seen that brands do tend to pull back from placing ads next to news stories due to brand safety concerns. So it’s not unreasonable to think that some of these current headwinds dissipate relatively quickly.

Interestingly, Taboola reported results this morning, and while the stock responded positively, TBLA reported metrics that were worse than Outbrain’s! TBLA reported flat Ex-TAC GP vs. OB which was up +8%. In terms of next quarter, TBLA is guiding for +8% growth vs OB at +5%. Taboola management did sound a lot more upbeat during the call relative to Outbrain, in all fairness. So what’s driving the difference? My guess is that OB is a lot more exposed to top-of-funnel advertising vs. TBLA which skews more heavily towards direct response, and e-commerce in particular. That might explain why OB is being more cautious in the current environment relative to TBLA.

On that Taboola note, however, one thing that I want to highlight is the discrepancy between the stocks. These are stocks that have traded pretty closely together historically, which makes sense, given the similarity. However, this relationship broke down significantly over the past 3 months. I’m not exactly sure what’s driving that. Perhaps it’s the difference between being a small cap and a micro-cap in this tough tape? Or the difference between trading $4m vs $400k? Whatever is driving it, I think it illustrates the value discrepancy here.

So what is the plan? From here, I plan on sitting tight. I want to give the company another quarter at least. For me to hold the position past Q4 results, I would want to see the company beat its Ex-TAC gross profit guidance. I think for the stock to re-rate, we really need to see continued re-acceleration otherwise this won’t work. If we do see this, I think the stock is set up nicely at ~1.8x ‘24 EBITDA. At a 6x multiple (closer to TBLA) this could be an $8 stock.

Thanks for the update.

i can't find the original article on AVRO but does the thesis still hold? technically starting to look decent