Outbrain ($OB)

A highly asymmetric stock with ~60% of market cap in net cash and at ~1x EBITDA with improving fundamentals.

Welcome, Absolute Value readers! I am back with a new and very asymmetric idea today: Outbrain. I hope you like it!

As always, if you have feedback or suggestions on what I should look into, send me a note to info@clarksquarecapital.com or @clarksquarecap on Twitter.

If my work has been helpful, please share it with a friend or colleague, and don’t forget to hit subscribe below! Thanks for reading!

Investment Thesis Summary

I believe that an investment in the common shares of Outbrain (trading on the Nasdaq, ticker: $OB) is compelling for the following reasons:

Revenue and EBITDA are set to accelerate over the back half of 2023.

OB has a defensible position in a duopoly industry. Furthermore, the move toward measurable results and greater user privacy should result in long-term tailwinds for the company.

OB is incredibly asymmetric given that net cash makes up ~60% of the market cap and has an extremely low valuation of ~2.1x EBITDA on my 2023 estimate and ~1.3x on 2024E. On guided numbers, it trades at ~3x EBITDA.

Outbrain’s management team has proven to be skilled at capital allocation and is likely to continue to add value over time.

All-in, I see an easy path for the stock to be worth at least $8/share, or a double from today’s current price.

Why this might be mispriced:

Outbrain is a broken IPO that came to market in mid-2021.

Post-IPO, fundamentals deteriorated given a more difficult advertising environment, particularly in Europe.

OB’s stock performance has been abysmal: the company IPOed at $20 and is currently trading below $4 per share.

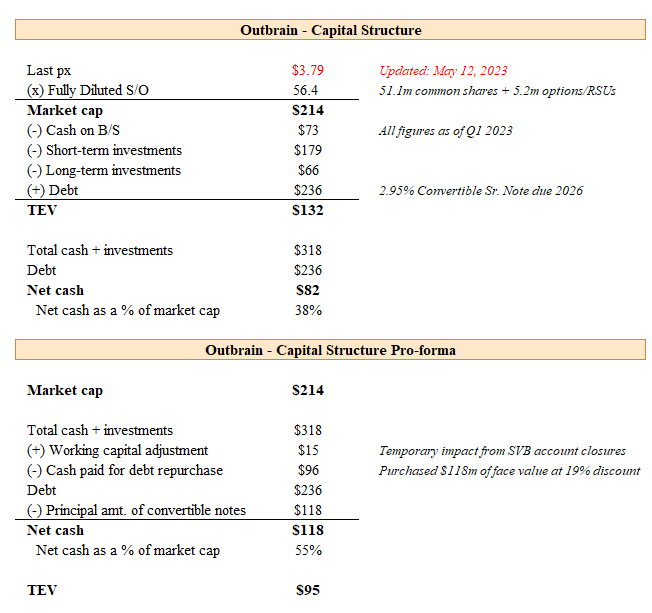

OB splits its cash balances into three categories: cash, short-term investments, and long-term investments. Some data services do not include LT investments (which are cash) in their calculation of enterprise value. EV is overstated, which makes the company look optically expensive.

Capital Structure

Outbrain has a market cap of $214m and an enterprise value of $95m. I am calculating the EV pro-forma for their most recent debt repurchase and adjusting it for a temporary working capital issue they faced in Q1 2023.

A quick word on terms unique to Outbrain / ad-tech

Click-through rate (CTR) - usually calculated as a percentage of users who “click through” an ad. Services like OB typically have CTRs in the ~1% area.

Return on ad spend (ROAS) - advertisers calculate the incremental revenue generated from an intended action (usually a click). The higher the ROAS, the better.

Cost-per-click (CPC) - a metric that determines how much advertisers pay for the ads they place on websites or social media, based on the number of clicks the ad receives.

Traffic acquisition costs - These are the “splits” that are paid out to news publishers as their share when people click through on an ad. Roughly for every $1 generated, publishers are paid $0.20 to $0.30. The revenue line includes these payments, which are then subtracted.

Gross profit ex. TAC - This line item subtracts traffic acquisition costs. For all intents and purposes, this should be the cleanest “net revenue” that is generated for the company. It also makes sense to calculate other expenses based on this number (for instance, EBITDA as a % of GP ex-TAC).

Business Background

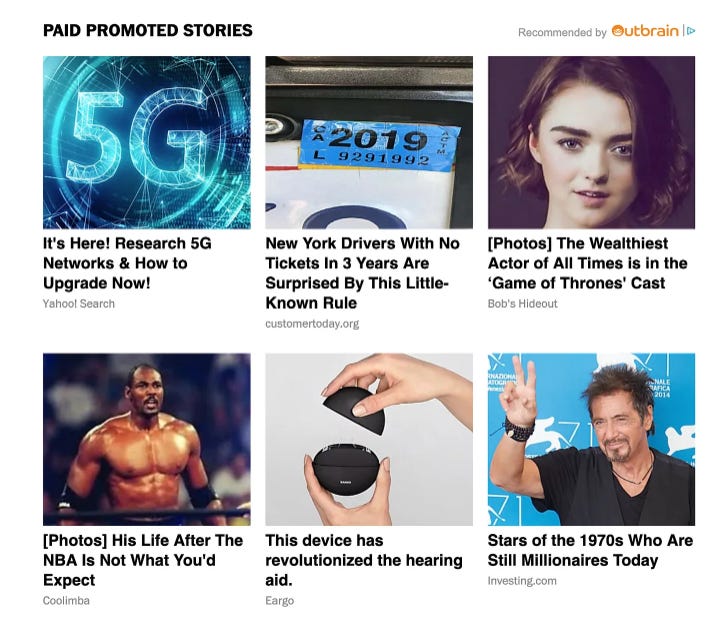

Outbrain is an advertising technology (ad-tech) company that connects publishers (primarily news) with advertisers. OB helps publishers monetize space and traffic on their websites by generating boxes of ads and content (sometimes referred to as a chumbox, as seen below). Outbrain then shares a portion of this revenue with publishers. The company is currently partnered with top news players in the US and abroad, including Fox News, Axel Springer, Le Mond, the Washington Post, and others. Outbrain’s main competitor is Taboola.

There are a few key things I would highlight about OB and its business model:

Unique supply and long-dated contracts - Unlike other ad-tech businesses, the supply that Outbrain has access to is entirely unique, as OB negotiates individual contracts with each publisher in deals that traditionally last 2-4 years. OB has a good track record of renewing contracts over time.

Outbrain is the only intermediary between publishers and advertisers - OB is the direct go-between publishers and advertisers, which means that there is only one layer of fees that are charged on the two-sided network; publishers are thus able to retain a greater percentage of the revenue and advertisers end up spending less, which makes the service more attractive.

More levers to pull than the traditional business - While most businesses can simply raise output or prices, OB has more levers to pull. They can increase the number of publishers on the platform, capture more budget from existing advertisers, or increase the number of advertisers, which can help drive higher pricing. Pricing is a function of the return on ad spend (ROAS) that is generated for advertisers, which is a function of click-through rates (CTRs). Increasing CTRs, and thereby, increasing ROAS, means that there is no upper bound on pricing, as long as advertisers are getting a sufficiently good return on their spending.

Low capital intensity - The business does not require much incremental capital to grow, with most of the costs being human talent and web hosting expenses, which are mostly expensed through the P&L (software development is capitalized, however, and amortized over time.)

Overall, I would characterize the business as “decent” and Outbrain as a better business than the typical ad-tech player given its unique supply and long-dated contracts.

Recent trends

Outbrain IPOed in July 2021 at a price of $20 per share (at a $1.1B valuation) in what quickly proved to be a horrific environment for technology companies. OB faced an incredibly tough 2022 as advertisers quickly pulled back on their ad spending sensing a more difficult consumer environment. Advertisers in Europe, where Outbrain does more than 40% of its business, were particularly hard hit as consumers were pressured by a cost of living squeeze (high inflation, rising mortgage costs, etc.); moreover, the Ukraine / Russia war generated a lot of stories where advertisers did not want to place their inventory. This resulted in one of the worst digital advertising environments for companies like OB. In Q3 and Q4 2022, OB experienced cost-per-clicks (CPCs) down about 20%. More recently, trends have started to stabilize.

Thesis

Revenue growth and EBITDA are set to accelerate over the back half of 2023.

Revenue inflection:

Strong underlying operating momentum: despite continued pricing pressure given a weaker advertising environment (seen as a decline in like-for-like sales), Outbrain has executed well, adding ~10% revenue every quarter from new partner accounts. Over the past few quarters, contribution to revenue from new clients started to accelerate (see below). 2021 new partner growth was ~7% while the most recent quarters have seen +16% and +11%.

A flat pricing environment will still lead to accelerating top-line: assuming no incremental improvement in like-for-like (LFL) sales (roughly equivalent to cost-per-clicks), Outbrain revenues are set to inflect over the next few quarters from 0% growth in Q2 to a mid to high teens rate in constant currency exiting Q4 (assumes that two-year LFLs simply stay flat, despite an improving backdrop). It’s important to note that comps ease meaningfully starting in Q2 of this year.

Foreign exchange will become a tailwind in the back half of the year: OB generates c. 60% of revenue outside of the US. I estimate that Q3 and Q4 are likely to have a +2-3% top-line benefit if the Euro stays at its current spot rate (1.08 USD/EUR).

EBITDA inflection:

EBITDA should grow at an even faster clip given operating leverage from higher sales. Management has been very disciplined on OPEX spending - expenses have been roughly flat throughout 2021/2022 and management intends to keep them flat throughout the remainder of the year.

The effective take rate is also set to improve, as OB has been paying out greater than normal splits due to ~20% of contracts having minimum guarantees. As pricing recovers, the effective take rate should increase from ~23% to at least 25% within the next 1-2 years (although the effective take rate has gotten as high as 26-27%).

In Q4 2022, management laid out guidance for 2023 that called for “at least $28m” in EBITDA (which was reiterated in Q1). This guidance, however, assumes that there is no improvement in the industry despite seeing early signs that Europe (which is >40% of revenue) is starting to recover. Similarly, Taboola called out strength in e-commerce during their Q1 2023 earnings call, which should also bode well for Outbrain. Given the combination of tight expense management, easy comps, and a possible recovery in ad prices, I believe that the company’s $28m guide for EBITDA should be easily beatable for 2023.

2024 is likely to prove even better, as OB has continued to add new large publishers and continues to make improvements in CTRs to drive returns for advertisers. Coupled with a potential improvement in pricing, I believe that 2024 EBITDA is likely to be meaningfully higher than what the sell-side is modeling.

OB has a defensible position in a duopoly industry.

There is a real value proposition for both advertisers and publishers, as OB has an integrated ecosystem in which there are no intermediaries. This avoids markups, which drives the overall take-rate lower for advertisers and publishers get to keep a greater percentage of the money spent.

Outbrain also operates what is essentially a two-sided network, which is exceedingly difficult to re-create from scratch, given the need to have both supply (space on a publisher’s page) and demand (having advertisers on board, which are driving meaningful ROAS) simultaneously.

Outbrain also has exclusive relationships with some of the largest news publishers, which typically sign on for 2-4 year contracts. On average, publishers have been in business with Outbrain for ~7 years, which proves that Outbrain is delivering a valuable service that should continue to be around for a while.

The move in digital advertising toward measurable results and greater user privacy should result in long-term tailwinds for the company.

Advertisers using digital channels want to use services that offer them the ability to accurately track the effectiveness and efficiency of their campaigns (even for non-performance marketing). Outbrain is well positioned for this, as having an integrated ecosystem allows it to observe and report real results.

Moreover, Oubtrain is well positioned for an environment that favors greater user privacy, as it does not rely on tools that track users throughout the web such as cookies. Outbrain is able to leverage first-party data (shared by publishers) and use contextual advertising (i.e. place ads next to relevant news stories) to drive results. However, there is little risk that performance will degrade if cookies go away over time.

OB is incredibly asymmetric given that net cash makes up c. 60% of the market cap. Additionally, OB is currently trading at an extremely low valuation of ~2.3x EBITDA on my 2023 estimates and ~1.3x on my 2024 numbers.

Large margin of safety - OB has net cash on the balance sheet of ~$120m relative to a market cap of ~$210m. With ~60% of the market cap in cash, any downside should be relatively limited, particularly as OB is set to generate at least >$30m of EBITDA (according to management guidance), if not significantly more.

My valuation and price target are included below. I am valuing OB on my 2024 unlevered free cash flow number, which I estimate at ~$25m. I then apply a 12.5x multiple, which drives my $8/share price target. This implies an EBITDA multiple of ~4.3x, which is still relatively cheap, as Taboola is trading at a ~7x EBITDA multiple on 2024 consensus numbers.

I believe one could reasonably underwrite a higher price target. At a 5x or 6x EBITDA multiple, OB could trade in the $9-$10 per share range.

Outbrain’s management team has proven to be skilled at capital allocation and is likely to continue to add value over time.

Aligned incentives - The founder and current Co-CEO, Yaron Galai, owns approximately 6.3% of the company (3.6m shares) worth $14m.

The company’s management has proven adept at creating value:

In 2022, the company repurchased approximately 6.4m shares for approximately $30m.

In April 2023, the company repurchased $118m of senior convertible notes at a 19% discount to face value, paying $96m in cash. Purchasing debt at a discount created >$20m of value for equity holders.

More recently, in December 2022, the company’s Board authorized another share repurchase program of up to $30m. In Q1, OB repurchased 1.3m shares for $6m. With $24m left of capacity, if OB can repurchase 6m additional shares (at ~$4/share), the share count could be reduced by another 10% and this would create another ~0.40/per share in value for equity holders.

There are other interesting angles to the story that could drive further upside.

Taboola acquires Outbrain? - Combining Outbrain and Taboola would make perfect sense, as there would be obvious synergies between them, and the combined entity could better compete against the walled gardens as a champion of the open internet. The combination makes so much sense that it’s already been tried! In 2019, Outbrain and Taboola were set to merge before the proposal was called off during the depts of COVID in 2020 (at a valuation of $850m for Outbrain!) However, it’s not improbable to see Taboola try again, particularly given Outbrain’s ridiculously low valuation.

Emerging SaaS business - Outbrain is currently incubating a SaaS business that helps news publishers balance different business KPIs vs. user experience and editorial content. When first mentioned in Q1 2022, the business was on track to generate revenue of “a few million dollars” in 2022 with two large publishers as clients. Now, there are 7 publishers signed on, which likely means a MSD million-dollar revenue figure. At a 3-5x revenue multiple, this could be worth another $0.25 to $0.45 per share. Over the next few years, as this business continues to grow, it could add a meaningful chunk to the company’s enterprise value.

Valuation and Model

I am attaching my Excel model in case it’s useful.

As always, if you have feedback or suggestions on what I should look into, send me a note to info@clarksquarecapital.com or @clarksquarecap on Twitter.

If you have enjoyed the post, please subscribe below. Thanks for reading!

Revenue increasing, gross margins steady, that much is great, but there is a hole in this investment thesis through which capital is leaking fast. Just look at the obscene SBC numbers. Insiders are enriching themselves through a transfer of wealth from shareholders. That's why the operating margins are so awful. Investors have no long term hope in such a company if the management are intent on milking the cow to death. I see this kind of behavior as a huge red flag - poor stewardship. I welcome views of others, but please don't tell me that SBC aligns the interests of insiders with shareholders because it absolutely does not.

41% since you wrote this up vs, 13% for the Russell 2000, great work!